In today’s volatile economic landscape, managing financial risk is paramount to safeguarding your hard-earned wealth. Whether you’re an experienced investor or just starting your financial journey, understanding the potential pitfalls and implementing effective risk management strategies is crucial for achieving your financial goals and securing your financial future.

This comprehensive guide will delve into proven strategies and practical tips to help you navigate the complexities of financial risk management. We’ll explore key concepts such as risk assessment, diversification, and asset allocation, empowering you to make informed decisions and protect your wealth from potential threats.

What is Financial Risk Management?

Financial risk management is the process of identifying, analyzing, and mitigating potential financial risks that could negatively impact an individual or organization. It’s essentially about protecting your financial well-being from unexpected events that could lead to losses.

Risk itself refers to the possibility of something happening that could result in a gain or a loss. Financial risk specifically focuses on uncertainties surrounding financial outcomes. Will an investment pay off? Will you have enough money for retirement? These are the types of questions that financial risk management helps you address.

Effective financial risk management involves a continuous cycle of:

- Identifying Risks: Recognizing potential threats to your financial health (e.g., market volatility, job loss, inflation).

- Assessing Risks: Determining the likelihood of those threats occurring and the potential severity of their impact.

- Managing Risks: Implementing strategies to reduce the probability of risks happening and minimize potential losses (e.g., insurance, diversification, emergency funds).

- Monitoring Risks: Regularly reviewing and adjusting your approach as your financial situation and the economic environment evolve.

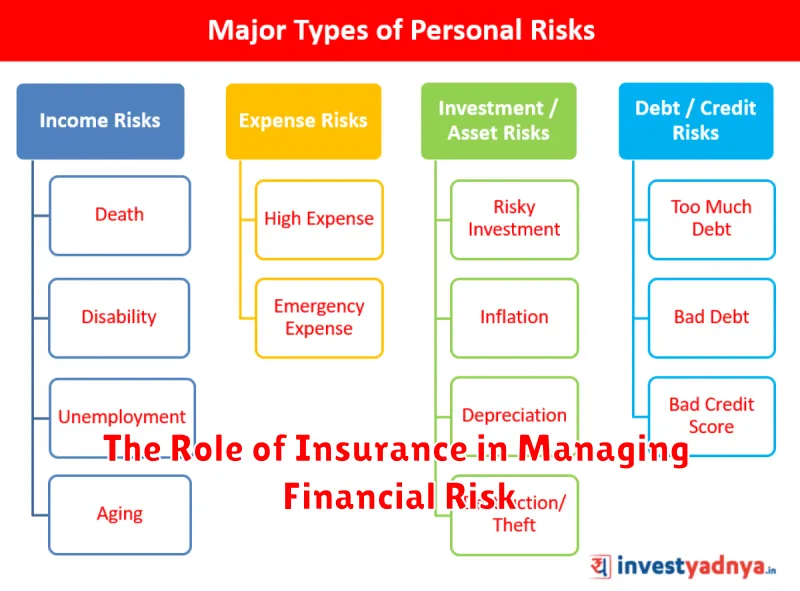

Different Types of Financial Risks and How They Impact You

Understanding the different types of financial risks is the first step towards protecting your wealth. Here’s a breakdown of some common risks and their potential impact:

1. Market Risk

This refers to the risk of losing money due to fluctuations in the market. Stocks, bonds, and real estate can all be impacted by market forces. Economic downturns, interest rate changes, and even geopolitical events can trigger market volatility, leading to potential investment losses.

2. Interest Rate Risk

Primarily affecting debt investments like bonds, interest rate risk stems from the fluctuating value of these assets as interest rates change. When interest rates rise, the value of existing bonds generally falls. Conversely, when interest rates fall, the value of existing bonds tends to rise.

3. Inflation Risk

Inflation erodes the purchasing power of your money over time. This means that a fixed amount of money today will buy less in the future. It’s crucial to consider inflation when planning for retirement and other long-term financial goals, as it can significantly impact your future cost of living.

4. Liquidity Risk

Liquidity risk arises when you can’t easily convert an asset into cash without a significant loss in value. Real estate and some alternative investments are examples of assets that might present liquidity risk. It’s important to consider your time horizon and need for access to funds when investing in illiquid assets.

5. Credit Risk

Credit risk is the possibility that a borrower, such as a company or individual, will fail to repay a debt. This risk is most closely associated with bonds and loans. Investors can mitigate credit risk by carefully assessing the creditworthiness of borrowers.

Strategies for Diversifying Your Investment Portfolio

Diversification is a risk management strategy that involves spreading your investments across a range of asset classes, such as stocks, bonds, and real estate. By diversifying your portfolio, you can reduce the impact of any one investment on your overall portfolio.

There are many different ways to diversify your investment portfolio. One common approach is to use asset allocation, which is the process of dividing your portfolio among different asset classes. The specific asset allocation that is right for you will depend on your individual circumstances, such as your risk tolerance, time horizon, and financial goals.

Another important aspect of diversification is to diversify within asset classes. For example, even within the stock asset class, you can diversify by investing in stocks of companies of different sizes, industries, and geographic locations.

Diversification is a key element of managing financial risk. By diversifying your investment portfolio, you can reduce the risk of losing money and increase your chances of achieving your financial goals.

The Role of Insurance in Managing Financial Risk

Insurance plays a crucial role in managing financial risk by providing a safety net against unexpected events that could lead to significant financial losses. It operates on the principle of risk transfer, where you pay a premium to an insurance company in exchange for their promise to compensate you for covered losses.

Different types of insurance address various financial risks:

- Health insurance protects you from potentially devastating medical expenses.

- Auto insurance covers damages or losses related to vehicle accidents.

- Property insurance safeguards your home and belongings against perils like fire, theft, or natural disasters.

- Life insurance provides financial support to your beneficiaries in the event of your death, ensuring their financial security.

By having appropriate insurance coverage, you are essentially transferring the financial responsibility of these risks to the insurance company. This transfer allows you to gain peace of mind, knowing that you are protected from the potentially catastrophic financial consequences of unexpected events. It frees up your financial resources to focus on other financial goals, such as saving, investing, and retirement planning, instead of worrying about potential losses.

How to Create a Financial Risk Management Plan

A financial risk management plan is essential for safeguarding your assets and ensuring long-term financial stability. It involves identifying potential financial risks, assessing their potential impact, and developing strategies to mitigate them. Here’s a step-by-step guide on how to create one:

1. Identify Potential Financial Risks: Begin by identifying potential risks that could impact your financial well-being. These might include:

- Market Volatility

- Interest Rate Fluctuations

- Inflation

- Job Loss

- Medical Emergencies

2. Assess the Impact: Once you’ve identified potential risks, evaluate their potential impact. Consider both the likelihood of the risk occurring and the severity of its consequences.

3. Develop Risk Mitigation Strategies: The next step is to develop strategies to mitigate the identified risks. This might involve:

- Risk Avoidance: Avoiding activities that expose you to a particular risk.

- Risk Reduction: Taking steps to minimize the likelihood or impact of a risk.

- Risk Transfer: Transferring the financial burden of a risk to a third party, such as through insurance.

- Risk Acceptance: Accepting the potential consequences of a risk if the potential rewards outweigh the risks.

4. Implement Your Plan: Put your risk management plan into action by implementing the strategies you’ve developed. This might involve diversifying your investment portfolio, establishing an emergency fund, or purchasing insurance policies.

5. Regularly Review and Update: Financial situations and risk landscapes change over time. Regularly review and update your risk management plan to ensure it remains aligned with your financial goals and circumstances.

Tips for Protecting Your Assets from Financial Loss

Protecting your assets from financial loss is crucial for preserving your wealth and achieving your long-term financial goals. Here are some tips to help safeguard your hard-earned money:

1. Diversify Your Investments: Don’t put all your eggs in one basket. Diversifying your investment portfolio across different asset classes, such as stocks, bonds, and real estate, can help mitigate losses in case one asset class performs poorly.

2. Manage Debt Wisely: High levels of debt can put a strain on your finances and increase your risk of financial loss. Prioritize paying down high-interest debt and avoid taking on unnecessary debt.

3. Have an Emergency Fund: Unexpected events, such as job loss or medical emergencies, can happen to anyone. Having an emergency fund with 3-6 months’ worth of living expenses can provide a financial cushion during tough times.

4. Protect Your Income: Your income is your most valuable asset. Consider disability insurance to replace lost income if you’re unable to work due to illness or injury.

5. Review Insurance Coverage: Ensure you have adequate insurance coverage for your home, car, health, and other valuables. Review your policies regularly to ensure they meet your current needs.

6. Estate Planning: Create or update your will, trust, and other estate planning documents to ensure your assets are distributed according to your wishes and to minimize potential estate taxes.

7. Be Aware of Scams: Be cautious of investment scams and fraudulent schemes. If an investment opportunity sounds too good to be true, it probably is.

8. Seek Professional Advice: Consider consulting with a qualified financial advisor who can provide personalized advice based on your individual financial situation and goals.

By following these tips, you can take proactive steps to protect your assets from financial loss and secure your financial future. Remember, financial security is an ongoing process that requires diligence and careful planning.

Common Mistakes in Financial Risk Management and How to Avoid Them

Effectively managing financial risk is crucial for protecting your wealth. However, it’s easy to make mistakes that can be costly. Understanding common pitfalls can help you make more informed decisions and safeguard your financial future. Here are some frequent errors to watch out for:

1. Lack of Diversification: Putting all your eggs in one basket, whether it’s stocks, bonds, or real estate, exposes you to significant risk if that asset class declines. Diversifying your portfolio across different asset classes, industries, and geographies can help mitigate losses.

2. Ignoring Risk Tolerance: Your risk tolerance refers to your capacity and willingness to handle investment fluctuations. It’s essential to invest in alignment with your risk appetite. Taking on too much risk can lead to anxiety and poor decision-making, while being overly conservative might hinder potential returns.

3. Emotional Decision-Making: Fear and greed can cloud judgment and lead to impulsive actions. It’s crucial to make rational decisions based on your financial plan and market conditions, not on emotions.

4. Chasing Past Performance: Past performance is not indicative of future results. Relying solely on historical returns can be misleading. Conduct thorough research and consider various factors before making investment choices.

5. Neglecting Long-Term Goals: Short-term market fluctuations should not derail your long-term financial plan. Stay focused on your goals and avoid making hasty changes based on temporary market swings.

6. Inadequate Research: Investing without proper research is like sailing without a compass. Take the time to understand the investments, their risks, and their potential impact on your portfolio.

7. Overlooking Fees and Expenses: High fees and expenses can eat into your returns over time. Be mindful of expense ratios, transaction costs, and other charges associated with investments.

By recognizing these common mistakes and taking steps to avoid them, you can enhance your financial risk management strategies and increase the likelihood of achieving your financial goals while safeguarding your wealth.