Millennials are facing a financial landscape unlike any generation before them. Between student loan debt, a volatile job market, and the rising cost of living, achieving financial security can feel like an uphill battle. But don’t despair! With the right knowledge and a proactive approach, you can take control of your finances and build a bright future.

This article will equip you with actionable financial planning tips tailored specifically for millennials. We’ll cover essential strategies for budgeting, saving, investing, and managing debt, empowering you to make informed decisions and lay the foundation for a secure financial future.

Why Financial Planning is Important for Millennials

Financial planning is crucial for everyone, but it holds particular significance for millennials. This generation faces a unique set of financial challenges, from student loan debt and a competitive job market to the rising cost of living.

Effective financial planning empowers millennials to navigate these challenges. By setting financial goals, creating a budget, and investing wisely, millennials can build a solid foundation for a secure financial future. It allows them to take control of their finances, reduce financial stress, and work towards achieving their aspirations, whether it’s buying a home, starting a business, or retiring comfortably.

How to Set Financial Goals in Your 20s and 30s

Your 20s and 30s are pivotal decades for establishing a strong financial foundation. Setting clear financial goals is crucial during this time to achieve long-term financial security. Here’s a roadmap to help you navigate this important aspect of your life:

1. Identify Your Values and Aspirations: Begin by reflecting on what truly matters to you. Do you dream of owning a home, starting a family, traveling the world, or pursuing higher education? Defining your values will provide clarity and direction for your financial goals.

2. Create a Budget: A budget is an essential tool to track your income and expenses. Analyze your spending habits and identify areas where you can cut back. Allocate funds towards savings and investments. Numerous budgeting apps and online resources can assist you in this process.

3. Build an Emergency Fund: Life is full of surprises, and it’s crucial to be prepared for unexpected expenses. Aim to save three to six months’ worth of living expenses in an easily accessible account. This fund will provide a financial cushion during unforeseen circumstances such as job loss or medical emergencies.

4. Prioritize Debt Management: If you have student loans, credit card debt, or other forms of debt, create a plan to manage and reduce it strategically. Explore options like debt consolidation or balance transfers to potentially lower interest rates and streamline repayment.

5. Start Investing Early: The power of compound interest is significant, especially when you start investing early. Explore different investment vehicles such as stocks, bonds, and mutual funds, and consider your risk tolerance and long-term financial goals. Consulting with a financial advisor can provide personalized guidance on creating an investment strategy.

6. Plan for Retirement: Retirement might seem far off, but it’s never too early to start planning. Enroll in your employer-sponsored retirement plan, such as a 401(k), and consider contributing enough to receive the full employer match if available. Explore Individual Retirement Accounts (IRAs) for additional retirement savings.

7. Review and Adjust Regularly: Your financial goals may evolve over time, so it’s essential to review and adjust them periodically. Life changes, career advancements, and market fluctuations can all impact your financial plan. Regularly assess your progress, make necessary adjustments, and seek professional guidance when needed.

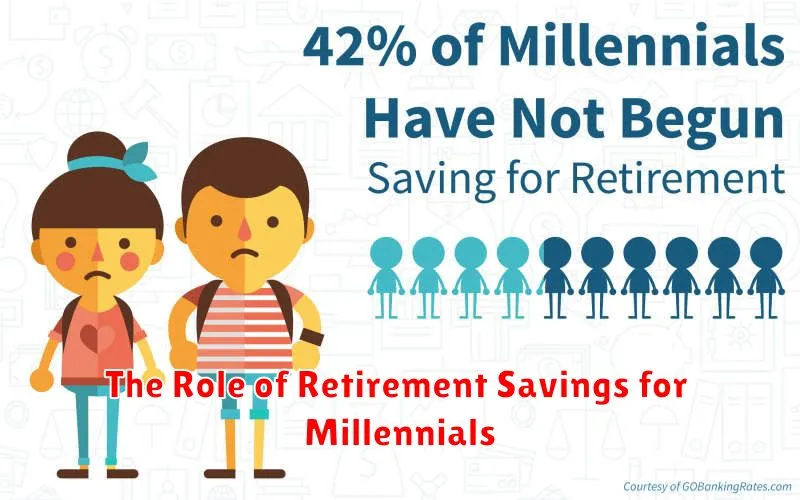

The Role of Retirement Savings for Millennials

Retirement might seem like a lifetime away for millennials, but starting early with retirement savings is crucial. The power of compound interest means that even small contributions made consistently over time can grow significantly.

Delaying saving for retirement can have a considerable impact. Millennials often face student loan debt and a higher cost of living than previous generations, making it tempting to put off retirement planning. However, the earlier a millennial starts, the less they’ll need to contribute each month to reach their retirement goals.

There are various retirement savings plans available, including employer-sponsored 401(k)s and individual retirement accounts (IRAs). Understanding the benefits of each and choosing the right plan is essential. Additionally, exploring investment options within these plans can help grow savings more effectively. Remember, the magic of compounding works best with time, making early retirement savings a vital aspect of financial planning for millennials.

Budgeting Tips for Millennials

Creating and sticking to a budget is crucial for financial success, especially for millennials who are navigating a complex financial landscape. Here are some practical budgeting tips tailored to your needs:

Track Your Spending

The first step to effective budgeting is understanding where your money goes. Use budgeting apps, spreadsheets, or even a notebook to track your income and expenses for a month or two. This will give you a clear picture of your spending habits.

Differentiate Between Needs and Wants

Once you have a handle on your spending, categorize your expenses as “needs” (essentials like rent, groceries, and utilities) and “wants” (discretionary spending like dining out, entertainment, and shopping). Prioritize your needs and look for areas where you can cut back on wants.

Set Realistic Goals

Whether it’s saving for a down payment, paying off student loans, or investing for the future, having clear financial goals will motivate you to budget effectively. Break down your goals into smaller, manageable milestones.

Embrace the 50/30/20 Rule

This popular budgeting method suggests allocating 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. Adjust these percentages based on your individual circumstances and financial goals.

Automate Your Savings

Make saving effortless by setting up automatic transfers from your checking account to your savings account each month. Treat savings like a non-negotiable expense.

Explore Side Hustles

Consider supplementing your income with a side hustle or freelance work. The extra cash can accelerate your savings goals, help you pay off debt faster, or give you more financial breathing room.

Review and Adjust Regularly

Your budget isn’t set in stone. It’s important to review and adjust it periodically to reflect changes in your income, expenses, and financial goals. Life happens, so be prepared to adapt your budget as needed.

Investing for Long-Term Financial Security

Investing is crucial for long-term financial security, especially for millennials. Starting early allows you to harness the power of compound growth. This means your money grows exponentially over time as earned interest generates even more interest.

A diversified investment portfolio that aligns with your risk tolerance and financial goals is essential. Consider a mix of stocks for growth potential, bonds for stability, and other asset classes like real estate or commodities. Don’t be afraid to seek guidance from a financial advisor to determine the best investment strategy for your specific needs.

Remember that investing is a marathon, not a sprint. Stay patient, ride out market fluctuations, and focus on the long-term growth potential of your investments. By investing consistently and strategically, millennials can pave the way for a secure and prosperous financial future.

Dealing with Student Loans and Other Debts

Many millennials find themselves burdened with debt, primarily from student loans. Managing these debts is crucial for financial stability. Start by creating a detailed budget to track income and expenses, allowing you to identify areas for potential savings.

Prioritize paying down high-interest debts first, such as credit card balances, as they accrue interest quickly. Explore options for student loan repayment, such as income-driven repayment plans or loan forgiveness programs, to make monthly payments more manageable. Consider debt consolidation if you have multiple loans to simplify repayment and potentially secure a lower interest rate. Remember, tackling debt takes time and discipline, but actively managing it is essential for achieving long-term financial goals.

How to Build a Strong Financial Foundation

Building a strong financial foundation is crucial for millennials to achieve their long-term financial goals. It involves establishing responsible financial habits and making informed decisions about money management. Here’s how to get started:

1. Budgeting and Tracking Expenses: Start by creating a realistic budget that tracks your income and expenses. Track where your money is going using budgeting apps, spreadsheets, or a simple notebook. This will help you identify areas where you can cut back and save more.

2. Emergency Fund: Aim to build an emergency fund that covers 3-6 months of living expenses. This fund will act as a safety net during unexpected events like job loss or medical emergencies.

3. Debt Management: Prioritize paying down high-interest debts, such as credit cards. Explore debt consolidation options or balance transfer offers to lower interest rates and pay off debt faster.

4. Saving and Investing: Start saving early and regularly, even if it’s a small amount. Explore different investment options like retirement accounts (401(k), IRA) and low-cost index funds to grow your wealth over time.

5. Financial Education: Continuously educate yourself about personal finance. Read books, articles, and attend workshops to improve your financial literacy and make informed decisions.