Purchasing your first home is a significant milestone, often filled with excitement and a touch of overwhelm. A key step in this journey is understanding mortgages. This comprehensive guide breaks down everything a first-time homebuyer needs to know, from interest rates and down payments to closing costs and mortgage insurance.

Whether you’re just starting to explore homeownership or are ready to delve into the intricacies of loan options, this guide will equip you with the knowledge and confidence to navigate the mortgage process with ease. Let’s demystify mortgages and pave the way for your exciting journey into homeownership!

What is a Mortgage and How Does It Work?

A mortgage is simply a loan used to purchase a property. Instead of paying the full purchase price upfront, you make a down payment (a percentage of the total cost), and the mortgage covers the rest. You then repay this loan, plus interest, over a set period, typically 15 or 30 years.

Here’s how it works in a nutshell:

- You borrow a large sum from a lender (like a bank) to buy a house.

- The lender uses the property itself as collateral, meaning they can take ownership if you fail to make payments.

- You repay the loan through regular monthly installments that include both principal (the original loan amount) and interest.

Understanding the different parts of a mortgage, like interest rates, loan terms, and repayment schedules, is crucial for first-time homebuyers. In the following sections, we’ll dive deeper into these aspects to help you make informed decisions throughout your homebuying journey.

The Different Types of Mortgages Available

Navigating the world of mortgages can feel overwhelming, especially for first-time homebuyers. Understanding the different types of mortgages available is a crucial first step. Here’s a breakdown of some common options:

Fixed-Rate Mortgages: As the name suggests, these loans come with an interest rate that remains constant for the entire loan term (typically 15 or 30 years). This offers predictability in monthly payments, making it easier to budget.

Adjustable-Rate Mortgages (ARMs): In contrast to fixed-rate mortgages, ARMs have interest rates that can fluctuate throughout the loan term. They typically start with a lower introductory rate for a set period, after which the rate adjusts periodically based on market conditions.

Government-Backed Mortgages: These loans are insured by government agencies like the Federal Housing Administration (FHA), the U.S. Department of Veterans Affairs (VA), or the U.S. Department of Agriculture (USDA). They often have more lenient qualification requirements and lower down payment options, making them attractive to first-time buyers.

Jumbo Loans: These loans exceed the conforming loan limits set by Fannie Mae and Freddie Mac. They are often used for purchasing high-priced properties and typically come with stricter qualification requirements.

Choosing the right type of mortgage depends on your individual financial circumstances, risk tolerance, and long-term goals. Carefully consider the pros and cons of each option to determine the best fit for you. Consulting with a mortgage professional can provide personalized guidance in navigating these choices.

How to Qualify for a Mortgage as a First-Time Buyer

Qualifying for a mortgage is a crucial step in buying your first home. Lenders assess various factors to determine your eligibility and loan amount. Here’s a breakdown of what they look for:

Credit Score: Your credit score reflects your creditworthiness. A higher score increases your chances of approval and better interest rates. Aim for a score of 620 or above, though requirements vary by lender.

Debt-to-Income Ratio (DTI): Lenders use DTI to gauge your ability to repay the loan. Calculate it by dividing your total monthly debt payments by your gross monthly income. A DTI of 43% or lower is generally preferred.

Down Payment: Saving for a down payment is essential. While options like FHA loans require as low as 3.5% down, a larger down payment (20% or more) can secure lower interest rates and eliminate private mortgage insurance (PMI).

Employment History: Lenders prefer stability, so a consistent employment history for at least two years is generally required. Self-employed individuals may need to provide additional documentation.

Assets and Reserves: Demonstrating available assets, such as savings, investments, and retirement funds, reassures lenders of your financial stability and ability to cover closing costs and potential financial emergencies.

By understanding these key qualifying factors, preparing your finances, and researching various loan options, you can confidently navigate the mortgage process as a first-time homebuyer.

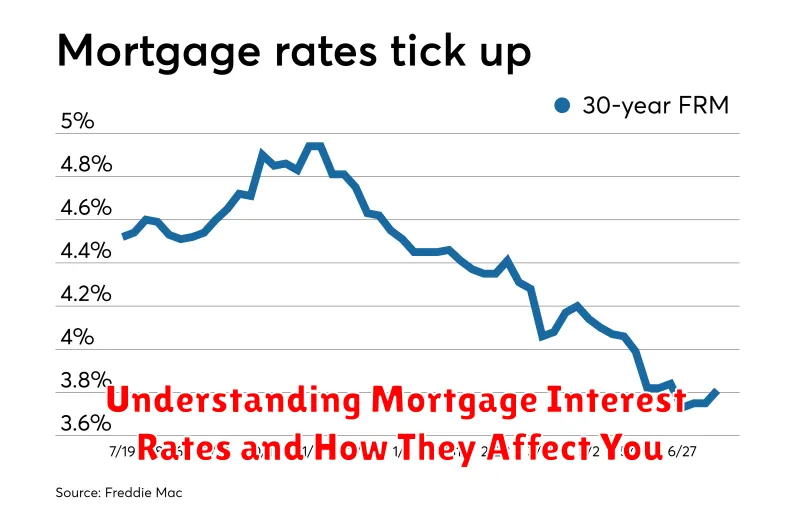

Understanding Mortgage Interest Rates and How They Affect You

As a first-time homebuyer, navigating the world of mortgages can feel overwhelming. One of the most crucial aspects to understand is the mortgage interest rate. Essentially, this rate represents the cost of borrowing money to purchase your home. It’s the percentage lenders charge you on top of the principal loan amount.

Mortgage interest rates directly impact your monthly mortgage payment and the total interest paid over the life of the loan. A higher interest rate means you’ll pay more each month and in total interest. Conversely, a lower interest rate translates to lower monthly payments and less overall interest paid.

Several factors influence interest rates, including broader economic conditions, Federal Reserve monetary policy, and your individual credit score and financial history. A strong credit score and healthy financial profile generally qualify you for lower interest rates, saving you significant money over time.

When considering a mortgage, it’s essential to compare rates from different lenders and carefully evaluate how different interest rates will impact your budget. Understanding this crucial aspect of a mortgage empowers you to make informed decisions and potentially save thousands of dollars throughout your homeownership journey.

How to Choose the Right Mortgage Lender

Choosing the right mortgage lender is crucial for a smooth and successful homebuying experience. With numerous lenders offering a variety of mortgage products, it’s essential to do your research. Here’s a guide to help you navigate this process:

1. Shop Around and Compare: Don’t settle for the first lender you come across. Get quotes from multiple lenders, including banks, credit unions, and online mortgage providers. Compare interest rates, loan terms, and fees associated with each offer.

2. Check Interest Rates and APR: The interest rate determines your monthly mortgage payments. The annual percentage rate (APR) includes the interest rate and other fees, providing a more comprehensive view of the loan cost. Aim for a lender offering competitive rates.

3. Understand Different Loan Options: Lenders offer various mortgage programs, each with different terms and eligibility requirements. Explore options like fixed-rate mortgages, adjustable-rate mortgages (ARMs), FHA loans, and VA loans to determine the best fit for your financial situation.

4. Consider Lender Fees and Closing Costs: In addition to the interest rate, lenders charge origination fees, appraisal fees, and other closing costs. Compare these costs across lenders to get a clear understanding of the total financial commitment.

5. Read Reviews and Seek Recommendations: Research online reviews and ask for recommendations from friends, family, or a real estate agent to gauge the lender’s reputation and customer satisfaction.

6. Evaluate Customer Service and Communication: Choose a lender known for responsive and helpful customer service. Clear communication throughout the mortgage process is vital for a stress-free experience.

Steps to Take Before Applying for a Mortgage

Getting ready to buy your first home is exciting, and a mortgage is a big part of that process. Before you jump into mortgage applications, here are some key steps to take:

1. Check Your Credit Score and History: Your credit score plays a vital role in determining your mortgage rate. Request your credit reports from all three bureaus (Equifax, Experian, TransUnion) and review them for any errors. Dispute any inaccuracies and work on improving your score if needed.

2. Determine Your Budget: Figure out how much house you can realistically afford. Consider all your monthly expenses and use online mortgage calculators to estimate potential payments. Aim for a mortgage that fits comfortably within your budget.

3. Save for a Down Payment: While there are loan options with low down payments, having a larger down payment (20% or more) can significantly lower your monthly payments and help you avoid private mortgage insurance (PMI).

4. Gather Necessary Documents: Start organizing your financial paperwork early on. Lenders typically require documents like W-2s, tax returns, bank statements, and proof of employment to assess your financial stability.

5. Research and Compare Lenders: Don’t settle for the first mortgage offer you receive. Shop around and compare interest rates, loan terms, and fees from different lenders to secure the best deal for your situation.

By taking these steps, you’ll be well-prepared to navigate the mortgage process and increase your chances of a smooth and successful home buying experience.

Common Mortgage Terms Every Homebuyer Should Know

Navigating the world of mortgages can feel like learning a new language. Understanding the terminology is crucial for first-time homebuyers to make informed decisions. Here are some common mortgage terms to familiarize yourself with:

Principal: This is the original amount of money you borrow from the lender to purchase your home.

Interest Rate: This is the percentage of the loan amount that the lender charges you for borrowing money. It is typically expressed as an annual percentage rate (APR).

Down Payment: This is the upfront payment you make towards the purchase price of your home. It is usually a percentage of the purchase price, and a larger down payment generally leads to more favorable loan terms.

Loan Term: This refers to the length of time you have to repay your mortgage loan. Common loan terms are 15 or 30 years.

Mortgage Insurance: If your down payment is less than 20% of the purchase price, you may be required to pay mortgage insurance, which protects the lender in case of default.

Closing Costs: These are the expenses you pay at the closing of your mortgage loan, including fees for appraisal, title insurance, and loan origination.

Escrow Account: This is an account held by your lender to pay for property taxes, homeowners insurance, and other related expenses. Your monthly mortgage payment may include an amount that goes into this account.

Understanding these common mortgage terms will empower you to confidently navigate the homebuying process. Remember to ask questions, compare offers from different lenders, and choose a mortgage that aligns with your financial situation and goals.