In a world of economic uncertainty, understanding the forces that directly impact your financial well-being is more crucial than ever. Inflation stands as one of the most significant economic challenges, gradually eroding the purchasing power of your hard-earned money. This occurs when the prices of goods and services increase over time, effectively diminishing what your money can buy.

This article serves as your comprehensive guide to understanding inflation, its causes, and its impact on your personal finances. We’ll delve into how inflation is measured, explore the factors that drive it, and most importantly, equip you with practical strategies to safeguard your money and build a more resilient financial future in the face of rising prices.

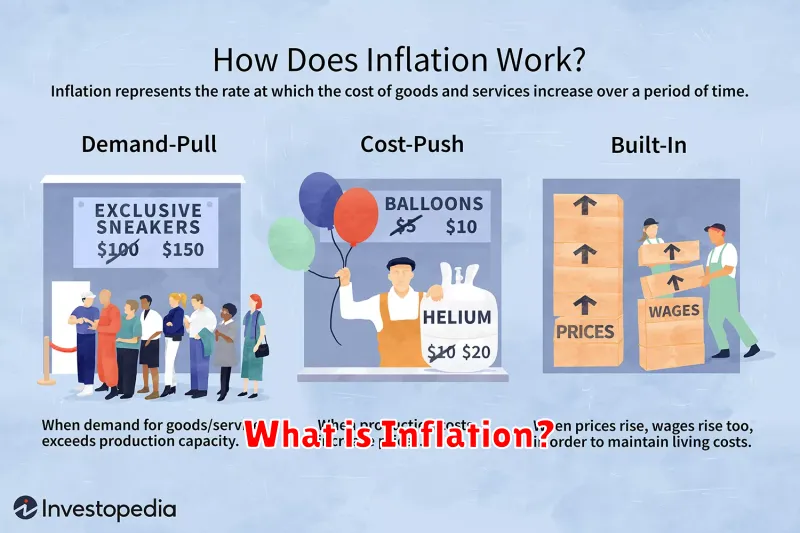

What is Inflation?

In simplest terms, inflation is the rate at which prices for goods and services rise over time. Imagine a basket of everyday items you might buy – groceries, gas, clothing. Inflation means you’ll need to spend more money to purchase that same basket of goods in the future.

This decrease in purchasing power is a key characteristic of inflation. Your money doesn’t literally disappear, but it simply buys less than it used to. A dollar today doesn’t stretch as far as it did a year ago.

Causes of Inflation and Its Economic Impact

Inflation, the persistent increase in the general price level of goods and services, can be triggered by several factors. Demand-pull inflation occurs when an economy experiences excessive demand relative to its production capacity, leading to consumers bidding up prices. This can be driven by factors like increased consumer spending, business investments, or government spending.

Cost-push inflation arises from the supply side, where rising production costs are passed onto consumers as higher prices. Key drivers include increasing raw material costs (like oil), rising wages, or supply chain disruptions.

The economic impact of inflation is significant. For individuals, inflation erodes purchasing power, making it harder to afford goods and services. Savings can also lose value over time. For businesses, inflation creates uncertainty, making planning and investment decisions more difficult.

How Inflation Affects Your Purchasing Power

Inflation is the rate at which prices for goods and services rise over time, resulting in a decrease in the purchasing power of your money. This means that a dollar today will buy you less in the future.

Imagine you have $10 today, and you can buy 10 apples with it. With an inflation rate of 2%, next year, those same 10 apples might cost $10.20. Essentially, your money is worth less because you need more of it to buy the same amount of goods.

This erosion of purchasing power affects everyone, especially those on fixed incomes or with savings in low-yield accounts. As inflation rises, their income or savings buy less and less, making it harder to maintain their standard of living. Understanding inflation and its impact is crucial for making informed financial decisions to protect yourself from its negative effects.

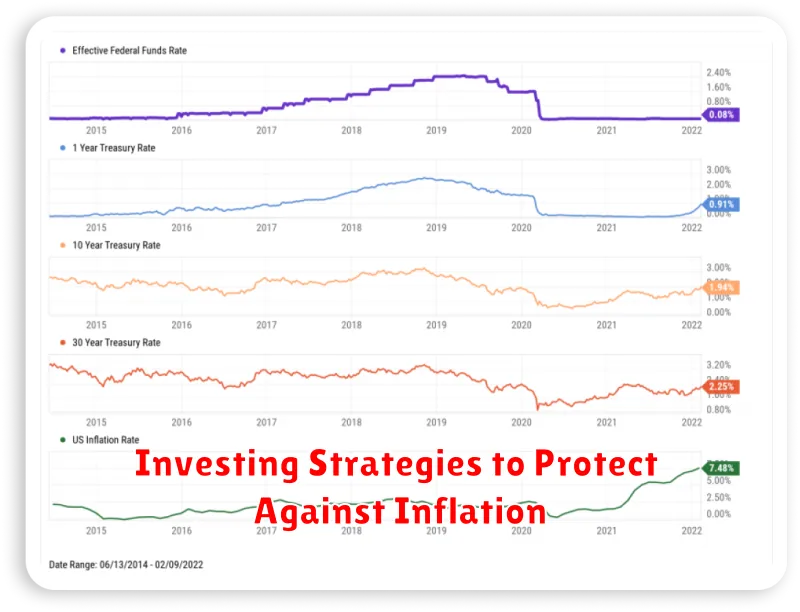

Investing Strategies to Protect Against Inflation

Inflation can significantly erode the purchasing power of your savings over time. It’s crucial to invest wisely to stay ahead of rising prices. Here are some strategies to consider:

1. Stocks: Historically, stocks have outpaced inflation in the long run. Investing in companies with pricing power and the ability to pass on rising costs to consumers can be a good hedge against inflation. Consider diversifying across different sectors and market capitalizations.

2. Real Estate: Real estate is often considered an inflation hedge because property values and rental income tend to rise with inflation. You can invest directly in properties or consider Real Estate Investment Trusts (REITs) for a more diversified approach.

3. Commodities: Commodities like gold, silver, and oil are tangible assets whose prices tend to rise with inflation. You can invest in physical commodities or consider commodity ETFs or mutual funds.

4. Treasury Inflation-Protected Securities (TIPS): TIPS are government bonds that adjust their principal value with inflation. This means that the interest payments and the principal repayment increase as inflation rises, providing a direct hedge against inflation.

5. Series I Savings Bonds: These U.S. government bonds offer a combination of a fixed interest rate and an inflation adjustment every six months. They can be a safe haven for your cash during periods of high inflation.

6. Diversification is Key: Don’t put all your eggs in one basket. Diversify your investments across different asset classes to reduce your overall risk. Consult with a financial advisor to create a portfolio that aligns with your risk tolerance, investment goals, and time horizon.

How to Adjust Your Budget During Inflationary Periods

When inflation rears its head, your hard-earned money doesn’t stretch as far. Your carefully crafted budget might suddenly feel the strain. Don’t panic, there are ways to adapt and stay afloat.

Track your spending. Understanding where your money is going is the first step. Analyze your expenses for a month or two – are there areas where you can cut back?

Prioritize needs over wants. Differentiate between essentials (housing, food, utilities) and discretionary spending (entertainment, dining out). Can you temporarily reduce your “wants” category to free up cash?

Negotiate or shop around. Don’t be afraid to negotiate better rates on bills like internet or insurance. Explore different grocery stores or consider generic brands to save on necessities.

Explore additional income streams. Could you take on a side hustle or freelance work to supplement your income during this period? Even a small amount can make a difference.

Review and adjust regularly. Inflation isn’t static, so your budget shouldn’t be either. Revisit your spending plan monthly, making adjustments as necessary to stay ahead of rising costs.

The Role of Government in Managing Inflation

Governments play a crucial role in managing inflation through fiscal and monetary policies.

Fiscal policy involves adjusting government spending and taxation. To curb inflation, governments can reduce spending or increase taxes, which decreases the overall demand in the economy and helps to cool price increases.

Monetary policy, often managed by a central bank, focuses on controlling the money supply and interest rates. Raising interest rates makes borrowing more expensive, which can slow down economic activity and reduce inflationary pressures.

The effectiveness of these policies depends on various factors, including the timing of interventions, the accuracy of economic forecasts, and the responsiveness of businesses and consumers to policy changes. Managing inflation is a delicate balancing act, as aggressive measures can also stifle economic growth.

Long-Term Effects of Inflation on Savings

Inflation erodes the purchasing power of your savings over time. This means that the same amount of money will buy you less goods and services in the future than it does today. This is particularly concerning for long-term savings goals, such as retirement, where even small rates of inflation can have a significant impact over time.

For example, if you have $10,000 in a savings account earning 1% interest, and inflation is running at 2%, your savings are actually losing value in real terms. After a year, you will have $10,100 in your account, but you will need $10,200 to buy the same goods and services you could have bought a year earlier.

Over the long term, the effects of inflation can be dramatic. If inflation averages 3% per year, something that costs $100 today will cost $243 in 30 years. This means that if you save $100 today, you will need to have $243 in 30 years to buy the same thing. Therefore, it is important to consider inflation when setting savings goals and to explore investment options that outpace inflation to preserve the purchasing power of your money over time.