Are you tired of living paycheck to paycheck, burdened by the weight of debt? The journey to financial freedom starts with a single step and a commitment to reclaiming control of your finances. This comprehensive guide will provide you with proven strategies and actionable steps to get out of debt and pave the way for a brighter financial future.

Whether you’re struggling with credit card debt, student loans, or simply living beyond your means, this guide will equip you with the knowledge and tools to create a budget, reduce expenses, and increase your income. We’ll explore various debt repayment methods, help you identify financial pitfalls to avoid, and empower you to make informed decisions that will lead you towards lasting financial stability.

Understanding the Different Types of Debt

Not all debt is created equal. Understanding the different types of debt you have is crucial for creating an effective debt payoff strategy. Here are some common categories of debt:

Secured Debt

This type of debt is backed by collateral, meaning the lender can seize the asset if you default on your payments. Examples include:

- Mortgages (collateralized by your home)

- Auto loans (collateralized by your car)

Unsecured Debt

Unsecured debt doesn’t have specific assets tied to it. Lenders have fewer options to recover their money if you don’t pay. Examples include:

- Credit cards

- Personal loans

- Medical bills

Revolving Debt

Revolving debt allows you to borrow up to a certain limit and make minimum payments. The available credit replenishes as you pay down the balance. Examples include:

- Credit cards

- Home equity lines of credit (HELOCs)

Installment Debt

Installment loans involve borrowing a fixed amount and repaying it over a set term with regular, equal payments. Examples include:

- Mortgages

- Auto loans

- Student loans

- Personal loans

Interest Rates: Debt types also differ by interest rates. Generally, secured debt like mortgages have lower interest rates than unsecured debt like credit cards. High-interest debt should be prioritized in your payoff plan.

By understanding the different types of debt and their characteristics, you can start to develop a targeted and effective plan to become debt-free.

Why Getting Out of Debt Should Be Your Top Priority

Being in debt can feel like carrying a constant weight on your shoulders. It can limit your options, increase your stress levels, and keep you from achieving your financial goals. That’s why getting out of debt should be your top priority.

Financial Freedom: Debt acts as a barrier to financial freedom. Every dollar you pay towards debt is a dollar you can’t use for something else, like saving, investing, or pursuing your passions.

Reduced Stress: The mental burden of debt can be overwhelming. Getting out of debt can significantly reduce stress and improve your overall well-being.

Improved Credit Score: A good credit score is crucial for obtaining favorable interest rates on loans and credit cards. Paying down debt improves your creditworthiness.

Future Security: By tackling debt now, you’re investing in a more secure financial future for yourself and your family. It allows you to save for retirement, handle emergencies, and achieve your long-term goals.

Creating a Debt Repayment Plan

A well-structured debt repayment plan is your roadmap to financial freedom. It starts with knowing exactly what you owe. List out all your debts, including interest rates, minimum payments, and loan terms. This gives you a clear picture of your current financial situation.

Next, prioritize your debts. There are two common approaches: the debt snowball, where you focus on paying off the smallest debts first for motivation, and the debt avalanche, where you prioritize debts with the highest interest rates to save money in the long run. Choose the method that resonates best with you.

Create a realistic budget that aligns with your repayment goals. Analyze your income and expenses, identify areas where you can cut back, and allocate as much as possible towards debt payments. This may involve making temporary lifestyle adjustments, but the payoff is worth it.

Remember, a debt repayment plan is not set in stone. Regularly review and adjust it as needed based on your progress and any changes in your financial situation. Stay committed, stay motivated, and celebrate your milestones along the way.

Debt Consolidation vs. Debt Settlement: What’s Best for You?

When struggling with debt, you might consider debt consolidation or debt settlement. These strategies can help manage your debt, but they work differently and have different outcomes. Understanding these differences is crucial for choosing the best option for your financial situation.

Debt consolidation involves taking out a new loan to pay off multiple existing debts. This simplifies your finances by combining multiple payments into a single monthly payment. Consolidation can be a good option if you can secure a loan with a lower interest rate than your current debts, saving you money on interest and potentially shortening your repayment term.

On the other hand, debt settlement involves negotiating with creditors to agree to accept a lower payoff amount than what you originally owed. This can be an option if you’re unable to meet your debt obligations. While debt settlement can significantly reduce your overall debt, it severely impacts your credit score and may have tax implications.

Choosing between debt consolidation and debt settlement depends on your individual circumstances, including your credit score, debt amount, and financial goals. Carefully weigh the pros and cons of each option to determine the best course of action for your journey towards financial freedom.

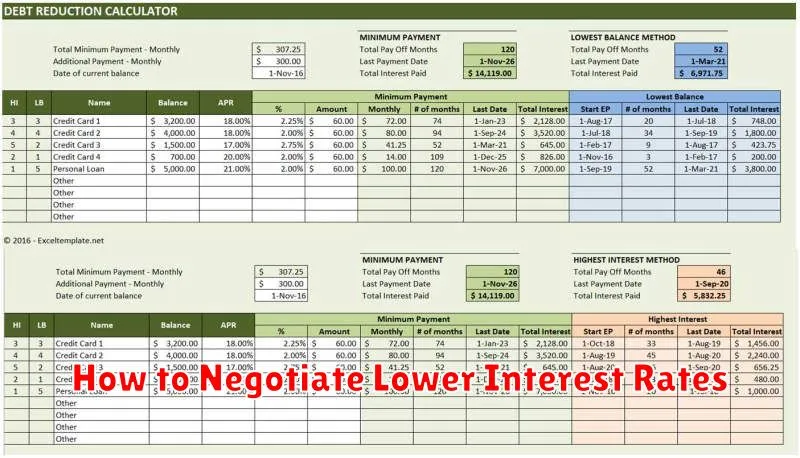

How to Negotiate Lower Interest Rates

Negotiating lower interest rates on your debts can be a powerful strategy to accelerate your journey out of debt and free up more cash flow. Here’s how to approach it:

1. Know Your Worth: Before you pick up the phone, check your credit score and review your payment history. A strong credit history strengthens your negotiating position.

2. Research and Compare: Investigate current interest rates for similar loan products. This information empowers you to negotiate competitively.

3. Be Prepared to Talk: Call your creditors and politely express your desire for a lower rate. Highlight your positive payment history, creditworthiness, and any competing offers you’ve received.

4. Be Persistent but Patient: Negotiation might take time. Don’t be afraid to ask to speak with a supervisor or try again at a later date if your initial attempt is unsuccessful.

5. Consider a Balance Transfer: If negotiations with your current creditor stall, explore transferring your balance to a credit card with a lower introductory rate. Be mindful of transfer fees and aim to pay off the balance before the introductory rate expires.

Avoiding Common Pitfalls When Paying Off Debt

Navigating your way out of debt requires a solid strategy and an awareness of potential pitfalls that can hinder your progress. Here are some common mistakes to avoid:

1. Not Having a Budget: A well-defined budget is paramount. It helps you track income and expenses, allowing you to identify areas where you can cut back and allocate more towards debt repayment.

2. Paying Only the Minimum Payment: Making minimum payments can keep you trapped in debt for years, accruing substantial interest charges along the way. Strive to pay more than the minimum whenever possible.

3. Ignoring High-Interest Debt: Prioritize paying off high-interest debts first. This strategy saves you money on interest charges in the long run.

4. Racking Up More Debt While Paying Off Existing Debt: To effectively climb out of debt, it’s crucial to stop accumulating new debt. Resist unnecessary expenses and focus on living within your means.

5. Not Seeking Help When Needed: Don’t hesitate to seek guidance from a financial advisor if you’re struggling. They can provide personalized strategies and support to help you achieve your financial goals.

Maintaining a Debt-Free Life After Paying Off Debt

Achieving a debt-free life is a massive accomplishment, but the journey doesn’t end there. Maintaining this financial freedom requires diligence and a shift in mindset. Here’s how to make debt a thing of the past:

1. Budget, Budget, Budget: Creating a realistic budget and sticking to it is crucial. Track your income and expenses meticulously to understand your cash flow and identify areas for saving.

2. Emergency Fund: Life throws curveballs. A robust emergency fund (3-6 months of living expenses) acts as a buffer against unexpected events, preventing a return to debt.

3. Cash is King: Transition to a more cash-based lifestyle. This encourages mindful spending and helps avoid the temptation of credit card debt.

4. Needs vs. Wants: Differentiate between necessities and desires. Prioritize needs and delay gratification on wants, allowing you to save and invest wisely.

5. Long-Term Goals: Set clear financial goals (retirement, homeownership, education). Having a target motivates responsible financial behavior and provides a sense of purpose.

6. Review and Adjust: Regularly review your budget and financial plan, making adjustments as needed to reflect changes in your income, expenses, or goals.

Maintaining a debt-free life requires ongoing effort, but the rewards are immeasurable. By adopting these strategies and remaining committed to financial responsibility, you can enjoy the freedom and peace of mind that comes with living debt-free.