Navigating the world of student loans can feel like stepping into a labyrinth. With so many different loan types, repayment options, and financial jargon to decipher, it’s easy to feel overwhelmed. Whether you’re a prospective student considering financing your education or a recent graduate staring down your first bill, understanding the ins and outs of student loans is crucial for your financial well-being.

This comprehensive guide will equip you with the knowledge and tools necessary to confidently navigate the student loan landscape. From demystifying common terms like interest rates and loan forgiveness to exploring various repayment strategies, we’ll empower you to make informed decisions about your financial future.

Understanding the Different Types of Student Loans

Navigating the world of student loans can feel overwhelming, especially with the array of options available. Before diving into repayment strategies or consolidation, it’s crucial to understand the different loan types you might encounter. Primarily, student loans fall into two categories: federal loans and private loans. Each comes with its own set of terms, interest rates, and repayment options.

Federal loans are funded by the government and typically offer more borrower-friendly terms. These loans come in several forms, including Direct Subsidized Loans (need-based with interest paid by the government while you’re in school), Direct Unsubsidized Loans (not need-based and interest accrues while you’re in school), and Direct PLUS Loans (available to graduate students or parents of undergraduate students). Federal loans often have fixed interest rates and offer income-driven repayment plans.

On the other hand, private loans are offered by private lenders like banks and credit unions. They may have variable interest rates and typically require a credit check. While private loans might offer lower interest rates initially, they often lack the flexibility and repayment options of federal loans. It’s essential to thoroughly compare terms and conditions before committing to a private loan.

Understanding the distinctions between these loan types is the first step towards making informed decisions about financing your education. By carefully evaluating your needs and researching available options, you can create a student loan strategy that best suits your financial situation.

How to Apply for Student Loans

Applying for student loans is a crucial step in funding your higher education. Here’s a breakdown of the process:

1. Complete the FAFSA: The Free Application for Federal Student Aid (FAFSA) is your gateway to federal loans, grants, and work-study programs. Fill it out accurately and submit it online or by mail.

2. Review Your Financial Aid Award Letter: Once your FAFSA is processed, you’ll receive a financial aid award letter from each school you’ve been accepted to. This letter will outline your eligibility for various forms of aid, including federal student loans.

3. Choose Your Loans: Carefully consider the types of federal loans offered—Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans—and compare their terms and interest rates. If you need additional funding beyond federal loans, explore private student loan options from banks and credit unions.

4. Complete Loan Counseling (if required): First-time borrowers of federal loans may be required to complete entrance counseling to understand their responsibilities.

5. Sign Your Master Promissory Note (MPN): The MPN is a legally binding document in which you promise to repay your loan(s) and any accrued interest and fees. You’ll typically sign a separate MPN for each type of loan.

6. Loan Disbursement: Once your school certifies your loan amounts, the funds will be disbursed directly to your school to cover tuition, fees, and other educational expenses. Any remaining funds may be refunded to you for living expenses.

The Pros and Cons of Federal vs. Private Student Loans

When it comes to financing your education, understanding the difference between federal and private student loans is crucial. Both options can help bridge the gap between your financial resources and the cost of tuition, but they come with distinct advantages and disadvantages.

Federal Student Loans

Pros:

- Lower, fixed interest rates: Federal loans generally offer more favorable interest rates than private loans, and these rates remain the same throughout the loan term.

- Flexible repayment options: Income-driven repayment plans and deferment or forbearance options provide safety nets during financial hardship.

- No credit history required: Most federal loans don’t require a credit check, making them accessible for students with limited credit history.

- Loan forgiveness programs: Certain professions may qualify for loan forgiveness programs after meeting specific requirements.

Cons:

- Limited borrowing amounts: Federal loans have annual and aggregate borrowing limits, which may not cover the full cost of attendance.

- Origination fees: Federal loans come with upfront origination fees that are deducted from the loan disbursement.

Private Student Loans

Pros:

- Higher borrowing limits: Private loans may offer higher loan amounts, potentially covering the full cost of attendance.

- Potential for lower interest rates: Borrowers with excellent credit may qualify for lower interest rates than federal loans.

Cons:

- Credit history required: Private lenders require a good credit history or a cosigner with good credit.

- Variable interest rates: Interest rates on private loans can be variable, meaning they can fluctuate over time, potentially increasing your monthly payments.

- Less flexible repayment options: Private loans typically offer fewer repayment options and may have stricter deferment or forbearance policies.

- No loan forgiveness: Private loans are not eligible for federal loan forgiveness programs.

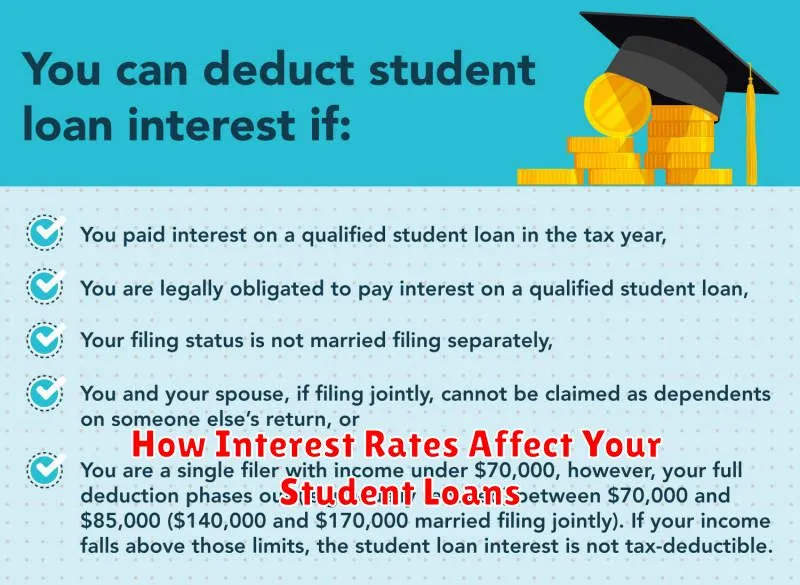

How Interest Rates Affect Your Student Loans

Interest rates are a crucial aspect of student loans that can significantly impact the overall cost of borrowing. When you take out a student loan, you’re essentially borrowing money that you’ll need to repay with interest. This interest rate determines how much extra you’ll pay back over the life of your loan.

Fixed interest rates remain the same throughout the loan term, providing predictability. In contrast, variable interest rates can fluctuate based on market conditions, meaning your monthly payments could increase or decrease over time.

A higher interest rate means you’ll accrue more interest on your loan, resulting in larger monthly payments and a higher total cost. Conversely, a lower interest rate will save you money over the life of your loan.

Understanding how interest rates work is essential for making informed decisions about your student loans. It’s crucial to compare rates from different lenders, explore options for securing lower rates, and consider the potential impact of interest capitalization on your overall debt.

Repayment Options for Student Loans

Navigating student loan repayment can feel overwhelming, but understanding your options can make the process smoother. Your repayment options will depend on whether you have federal or private loans.

For federal loans, you’ll typically have a standard repayment plan with fixed monthly payments for 10 years. However, you can explore other options like income-driven repayment plans, where your monthly payments are based on your income and family size. This can be helpful if you’re facing financial hardship. Other federal loan repayment options include graduated repayment (payments gradually increase over time) and extended repayment (stretches repayment over a longer period, up to 25 years).

Private loans, on the other hand, have repayment terms set by the lender. It’s essential to carefully review your loan agreement and contact your lender to discuss available repayment options. Some lenders might offer similar options to federal loans, such as income-based repayment or deferment in certain circumstances.

Remember, it’s crucial to communicate with your loan servicer if you’re facing difficulties making payments. They can help you understand your options and potentially avoid defaulting on your loans.

Tips for Managing Student Loan Debt

Navigating the world of student loans can feel overwhelming, but managing your debt effectively is crucial for your financial well-being. Here are some tips to help you stay on top of your loans and work towards a debt-free future:

1. Understand Your Loans: Before graduation, take the time to thoroughly review your loan terms, including interest rates, repayment options, and loan servicers. This knowledge will empower you to make informed decisions about repayment.

2. Create a Budget: Develop a realistic budget that accounts for your income, expenses, and loan payments. Identify areas where you can cut back on spending and allocate more funds towards debt reduction.

3. Consider Loan Repayment Plans: Explore different loan repayment plans, such as income-driven repayment or graduated plans, to find an option that aligns with your financial situation and goals.

4. Prioritize High-Interest Loans: If you have multiple loans with varying interest rates, prioritize paying down the loans with the highest interest rates first. This strategy will save you money on interest charges in the long run.

5. Explore Loan Forgiveness Programs: Research loan forgiveness programs that may be available to you, such as Public Service Loan Forgiveness (PSLF) or teacher loan forgiveness. These programs can provide significant debt relief for eligible individuals.

6. Make Extra Payments: Whenever possible, make extra payments towards your principal loan balance. Even small additional payments can accelerate your debt repayment journey and reduce the total interest paid.

7. Communicate with Your Loan Servicer: Maintain open communication with your loan servicer and inform them of any changes in your financial situation. They can provide guidance, answer questions, and assist you with exploring available options.

8. Seek Professional Advice: Consider consulting with a financial advisor who specializes in student loan debt management. They can provide personalized strategies and help you make informed decisions regarding your loans.

How to Refinance Your Student Loans for Better Terms

Refinancing your student loans can be a smart move to potentially save money and simplify your repayment process. Here’s a breakdown of how to refinance your loans for more favorable terms:

1. Check Your Credit Score and History: Lenders rely heavily on your creditworthiness. A higher credit score increases your chances of securing a lower interest rate. Obtain a free copy of your credit report, review it for accuracy, and take steps to improve your score if needed.

2. Research and Compare Lenders: Explore various lenders, including banks, credit unions, and online institutions, to find the most competitive interest rates and repayment options. Compare loan terms, fees, and eligibility requirements.

3. Prequalify with Multiple Lenders: Prequalification allows you to see potential rates and terms without a hard credit inquiry. This helps you compare offers and choose the best fit.

4. Choose the Right Loan Option: Select between fixed-rate loans (consistent monthly payments) and variable-rate loans (fluctuating rates based on market conditions), considering your financial situation and risk tolerance.

5. Complete the Application Process: Gather necessary documents, such as loan information and proof of income, and carefully review the terms before submitting your application to the chosen lender.

6. Start Repaying Your New Loan: Once approved, your new lender will pay off your existing loans, and you’ll begin making payments on the refinanced loan. Ensure timely payments to maintain good credit and maximize the benefits of refinancing.