Are you tired of feeling like you’re constantly running out of money at the end of the month? Do you wish there was a way to gain control of your finances and finally start working towards your financial goals? Creating a family budget is the single most effective way to get a handle on your money, and it’s not as daunting as it seems. This comprehensive guide will provide you with all the tools and information you need to create a budget that works for your unique family situation.

We’ll walk you through the entire process step-by-step, from identifying your income and expenses to setting financial goals and tracking your progress. Whether you’re starting from scratch, struggling to stick to a budget, or simply looking to improve your current budgeting strategies, this guide is for you. Let’s dive in and take the first step towards achieving your family’s financial dreams!

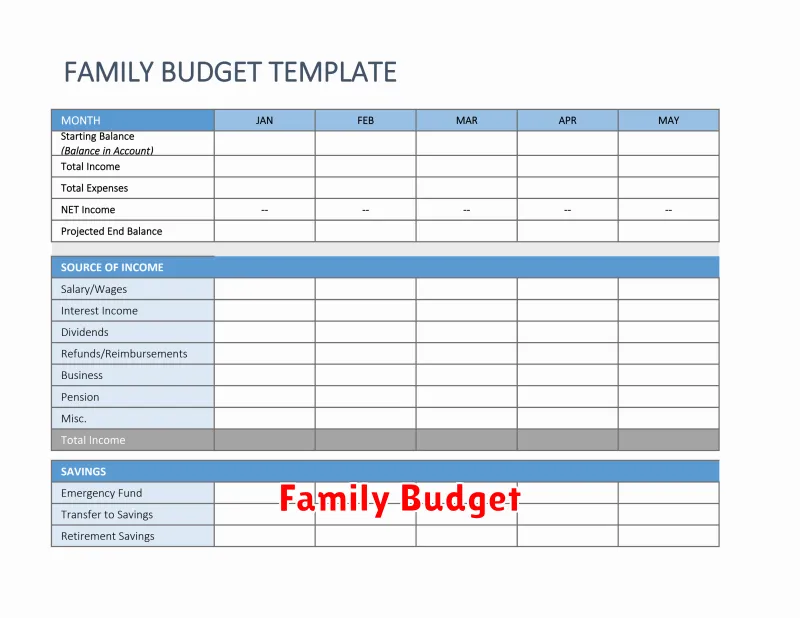

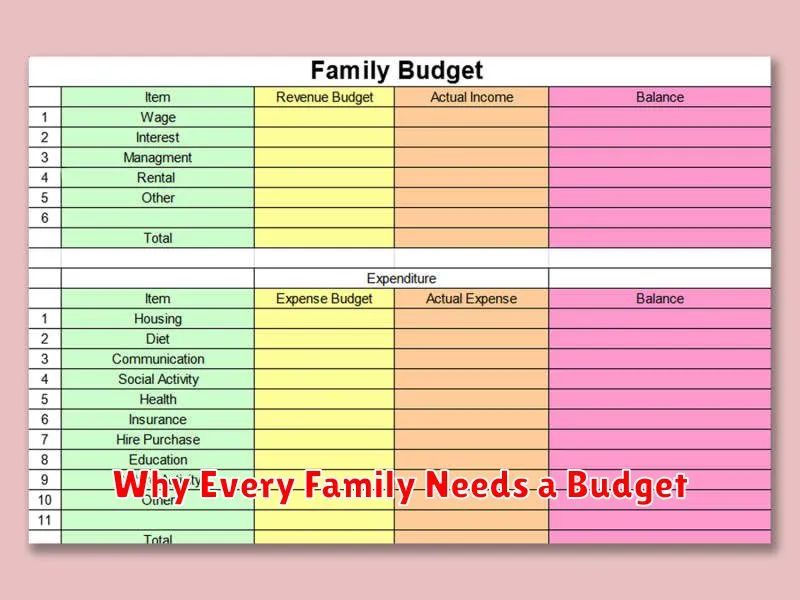

Why Every Family Needs a Budget

At its core, a family budget is a financial roadmap. It’s a plan for your money that dictates how much you earn, how much you spend, and on what. Without a budget, it’s easy to overspend, accumulate debt, and miss out on financial goals.

Financial Security is one of the most compelling reasons to create a family budget. By tracking income and expenses, you gain a clear picture of your financial health. This awareness allows you to identify areas to cut back on unnecessary spending, build an emergency fund, and save for the future.

A budget also facilitates communication about finances within a family. Openly discussing financial goals, constraints, and priorities ensures everyone is on the same page and working together towards shared objectives. This collaborative approach can significantly reduce financial stress and conflict.

Ultimately, a family budget empowers you to achieve your financial dreams. Whether it’s saving for a down payment on a home, funding your children’s education, or retiring comfortably, a budget provides the framework to make those dreams a reality.

How to Involve Your Family in Budget Planning

Creating a family budget is a team effort. Getting everyone involved, from your partner to your kids, can turn what can sometimes feel like a chore into an opportunity to teach valuable life skills and build financial responsibility as a family.

Start with a Family Meeting: Choose a time when everyone is relaxed and available. Explain the importance of a budget and how it benefits everyone. Make it clear that creating a budget is a team effort.

Give Everyone a Voice: Encourage open and honest discussions about needs and wants. Let each family member share their financial goals, whether it’s saving for a new toy or a family vacation. Actively listen to each other’s perspectives.

Age-Appropriate Tasks: Delegate age-appropriate tasks to your children. Younger kids can help clip coupons or research affordable options for family outings. Older children can track spending or research the cost of college.

Make it Fun and Engaging: Turn budget meetings into something enjoyable. Use games or visual aids to illustrate financial concepts. Celebrate successes, no matter how small, and frame challenges as opportunities to learn and adjust.

Remember, the key is to create a collaborative and supportive environment where everyone feels heard and respected. When families work together on their finances, they build a stronger financial future together.

Tips for Tracking and Managing Family Expenses

Tracking and managing family expenses is crucial for a successful budget. Here are practical tips to help you stay organized and in control of your finances.

1. Choose a Tracking Method: Select a tracking method that suits your lifestyle. You can use a budgeting app, spreadsheet, notebook, or a combination of these.

2. Track All Income and Expenses: Record all sources of income and every expense, big or small. Categorize your expenses to identify areas where you spend the most.

3. Set Realistic Spending Limits: Based on your tracking, set realistic spending limits for each category. This helps you prioritize needs over wants and avoid overspending.

4. Review Regularly and Adjust: Regularly review your tracking and make necessary adjustments to your budget based on your spending patterns and financial goals.

5. Involve the Family: Encourage family involvement in tracking expenses and discuss financial goals together to ensure everyone is on the same page.

6. Utilize Technology: Leverage budgeting apps and online banking tools to simplify tracking, set reminders, and automate bill payments.

7. Seek Professional Advice: If needed, don’t hesitate to seek guidance from a financial advisor to create a personalized budget plan.

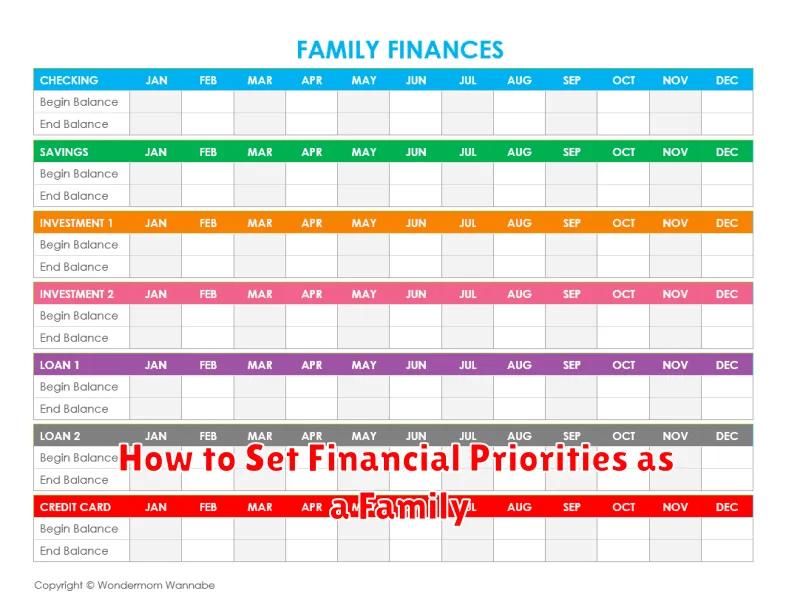

How to Set Financial Priorities as a Family

Setting financial priorities as a family is crucial for reaching shared goals and building a secure future. It involves open communication, understanding each other’s values, and making compromises to align your spending and saving habits.

Start by having an open and honest discussion about your family’s financial goals. Do you want to save for a down payment on a house, your children’s education, early retirement, or a family vacation? Prioritize these goals together, ranking them from most to least important.

Next, analyze your current spending habits. Identify areas where you can cut back to free up money for your prioritized goals. This might involve eating out less, finding more affordable entertainment options, or delaying non-essential purchases.

Remember that setting financial priorities is an ongoing process. Regularly review and adjust your budget and goals as needed, especially when circumstances change, like a new baby or a job transition. By working together and staying committed, you can achieve financial success as a family.

Creating a Savings Plan for Family Goals

Establishing a family budget isn’t just about tracking expenses; it’s also about planning for the future. This means creating a savings plan that aligns with your family’s goals. Whether it’s a down payment on a house, a dream vacation, your children’s education, or a comfortable retirement, identifying and prioritizing these goals is the first step.

Once you have a clear picture of your goals, both large and small, you can start setting realistic savings targets. Break down larger goals into smaller, more manageable milestones. This makes saving less daunting and allows you to track progress effectively. Determine how much you need to save each month to reach these milestones, and automate these transfers to a separate savings account.

Remember, your savings plan should be a living document. Regularly review and adjust it as your income, expenses, or goals change. Life is unpredictable, so be flexible and prepared to adapt your plan as needed. By aligning your savings with your family’s goals, you create a roadmap for a secure and fulfilling future.

How to Adjust Your Budget When Circumstances Change

Life is unpredictable, and even with the most well-crafted budget, unexpected events can arise, requiring adjustments to your financial plan. Whether it’s a job loss, a new addition to the family, or unexpected medical expenses, knowing how to adapt your budget to these changes is crucial for maintaining financial stability.

The first step in adjusting your budget is to reassess your income and expenses. If your income has decreased, identify areas where you can cut back on spending. Prioritize essential expenses such as housing, food, and utilities, and consider reducing or eliminating non-essential expenses like entertainment and dining out. Conversely, if your income has increased, allocate the extra funds towards savings, debt repayment, or long-term financial goals.

Next, review your financial goals. You may need to postpone certain goals or adjust your timeline based on your current circumstances. For example, if you were saving for a down payment on a house, you might need to delay your purchase or consider a more affordable property.

Communication is key when adjusting your budget, especially if it involves your family. Discuss the changes with your loved ones, explaining the reasons behind them and how everyone can contribute. This collaborative approach will foster understanding and make the transition smoother.

Remember that flexibility is essential. Be prepared to make further adjustments as needed, and don’t be afraid to seek professional financial advice if you’re struggling to manage your finances during times of change.

Common Challenges in Family Budgeting and How to Overcome Them

Creating and sticking to a family budget is essential for financial health, but it can come with its fair share of challenges. Understanding these common hurdles is the first step to overcoming them and achieving your financial goals.

One of the biggest challenges is inconsistent income. Fluctuations in paychecks can make it difficult to predict income and allocate funds accurately. A great solution is to create a “bare-bones” budget based on your lowest estimated income. This ensures you can cover essentials even during lean months. Additionally, explore ways to supplement your income through freelance work or side hustles.

Overspending is another common pitfall. Often, it’s small, seemingly insignificant expenses that add up over time. Implement the “30-day rule” for non-essential purchases. Wait 30 days before buying, and if you still truly want it, consider it in your budget. Tracking your spending, even for a short period, can be eye-opening and highlight areas where you can cut back.

Lack of communication among family members can derail even the most well-intentioned budgets. Hold regular family meetings to discuss finances, budget goals, and any challenges. Ensure everyone understands the importance of sticking to the budget and get everyone involved in the process. This fosters a sense of shared responsibility and accountability.

Finally, unexpected expenses can throw your budget off track. Building an emergency fund is crucial. Aim for 3-6 months of living expenses. When unexpected costs arise, dip into this fund instead of relying on credit cards. Remember, creating a budget is an ongoing process. Be flexible, adjust as needed, and celebrate your successes along the way!