The world of finance is evolving at an unprecedented pace, with digital banking at the forefront of this revolution. Gone are the days of rigid bank hours and tedious paperwork. Today, we’re witnessing a seismic shift towards mobile-first banking, AI-powered financial tools, and a seamless blend of technology and finance that’s reshaping how we manage our money.

This article delves into the exciting future of digital banking and explores the transformative impact it will have on your finances. From the rise of blockchain technology and cryptocurrencies to the emergence of personalized banking experiences, we’ll uncover the key trends and innovations poised to redefine your relationship with money. Get ready to navigate the future of finance and discover how you can harness the power of digital banking to achieve your financial goals.

What is Digital Banking?

Digital banking, at its core, refers to the digitization of traditional banking services. It encompasses all the ways you can interact with your bank and manage your finances online, without needing to physically visit a branch. This includes everything from checking your account balance on your phone to applying for a loan on your computer.

Instead of relying on paper statements and in-person interactions, digital banking leverages technology like mobile apps, websites, and online portals to provide 24/7 access to your financial life. This shift towards digital has revolutionized how we bank, offering increased convenience, flexibility, and often, lower fees.

How Digital Banking is Revolutionizing Financial Services

Digital banking is rapidly transforming the financial services landscape, offering unprecedented convenience, accessibility, and affordability to consumers and businesses alike. By leveraging technology, digital banks are streamlining traditional banking processes, empowering customers with greater control over their finances, and driving innovation across the industry.

One of the most significant ways digital banking is revolutionizing financial services is by providing 24/7 access to banking services through online platforms and mobile applications. Customers can check their balances, transfer funds, pay bills, and even apply for loans and credit cards from anywhere at any time, eliminating the need for physical branch visits and traditional banking hours. This increased accessibility has been particularly impactful for individuals in underserved areas or with busy schedules.

Furthermore, digital banks often operate with lower overhead costs compared to traditional institutions, allowing them to offer more competitive interest rates on savings accounts and lower fees on transactions and other services. This focus on affordability has attracted a large customer base, particularly among millennials and Gen Z who are accustomed to digital-first experiences and seeking cost-effective financial solutions.

Beyond convenience and affordability, digital banking is also driving innovation in financial services. By leveraging technologies like artificial intelligence (AI), machine learning (ML), and big data analytics, digital banks are providing personalized financial insights, automated financial advice, and sophisticated fraud detection capabilities. These innovative features are enhancing the customer experience, improving financial literacy, and strengthening security measures.

Benefits of Switching to Digital Banking

Switching to digital banking offers a range of benefits that can significantly improve your financial life. Here are some key advantages:

Convenience: Digital banking provides unparalleled convenience, allowing you to manage your finances anytime, anywhere, using your computer or mobile device. You can check balances, transfer funds, pay bills, and even deposit checks without visiting a physical branch.

24/7 Availability: Unlike traditional banks with limited operating hours, digital banking services are accessible round-the-clock. This means you can perform transactions or access your account information whenever it’s convenient for you, even outside of regular business hours.

Speed and Efficiency: Digital banking transactions are typically processed faster than traditional banking methods. Transfers, payments, and other operations are often completed in real-time or within a very short timeframe.

Cost Savings: Digital banks often have lower overhead costs compared to traditional institutions, allowing them to offer lower fees and better interest rates on savings accounts. You might benefit from reduced or waived monthly fees, ATM charges, and other banking expenses.

Enhanced Security: Digital banking platforms prioritize security and employ advanced technologies such as encryption and multi-factor authentication to protect your financial information. This helps safeguard your accounts from unauthorized access and fraudulent activities.

Security Measures in Digital Banking

Digital banking offers unparalleled convenience, but it also requires robust security measures to protect users from cyber threats. Here are some key security measures employed by banks:

Multi-factor authentication (MFA) adds an extra layer of security by requiring users to verify their identity through multiple methods, such as a password and a one-time code sent to their phone.

Encryption scrambles data making it unreadable to unauthorized individuals. This ensures that sensitive information transmitted between the user’s device and the bank’s servers remains confidential.

Biometric authentication, such as fingerprint scanning or facial recognition, provides a more secure and convenient alternative to traditional passwords.

Banks invest heavily in fraud detection systems that use sophisticated algorithms and machine learning to identify and flag suspicious activities in real-time.

Regular security updates and patches are crucial for addressing vulnerabilities and staying ahead of emerging threats.

By implementing these robust security measures, digital banking platforms strive to create a safe and trustworthy environment for users to manage their finances.

How Digital Banking Can Help You Save Money

Digital banking offers a plethora of tools and features designed to give you more control over your finances. Let’s explore how embracing the digital side of banking can lead to real savings.

Lower Fees: Traditional banks often have hefty fees associated with maintaining a physical branch network. Digital banks, with lower overhead costs, often pass these savings onto you through lower or even non-existent monthly fees, ATM charges, and overdraft protection.

Higher Interest Rates: Digital banks often provide more competitive interest rates on savings accounts and certificates of deposit (CDs). This means your money grows faster, helping you reach your financial goals quicker.

Budgeting and Saving Tools: Many digital banking platforms offer built-in budgeting tools that automatically categorize your spending, track your progress towards savings goals, and even suggest ways to cut back on unnecessary expenses.

Convenient Access and Control: With digital banking, you can manage your money anytime, anywhere. This ease of access makes it simpler to monitor your accounts, transfer funds, and avoid costly mistakes like missed payments.

By leveraging these advantages, digital banking empowers you to make smarter financial decisions and keep more of your hard-earned money in your pocket.

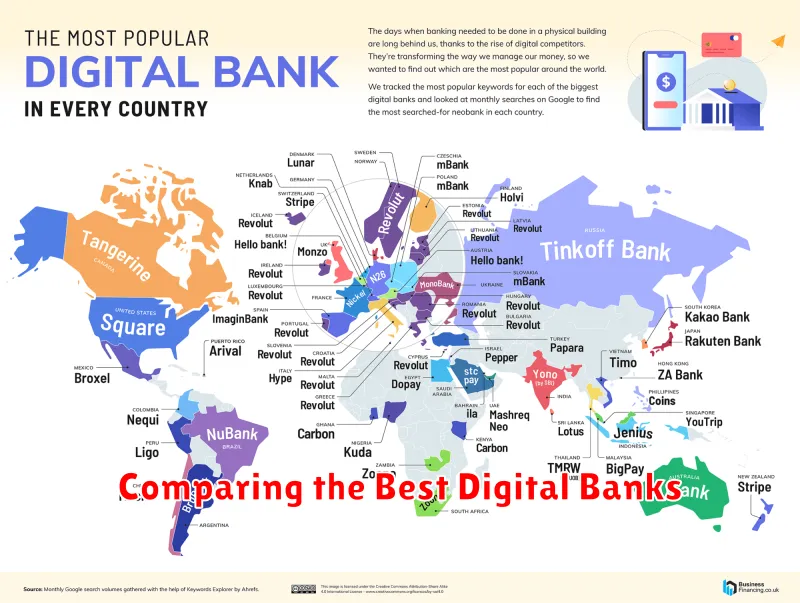

Comparing the Best Digital Banks

With the surge in popularity of digital banking, choosing the right institution for your needs can feel overwhelming. There are a plethora of factors to consider, from fees and interest rates to account features and customer service.

To help you navigate this evolving landscape, it’s crucial to compare key aspects of different digital banks. Look for institutions that offer low or no monthly fees, competitive interest rates on savings accounts, and user-friendly mobile apps with features like mobile check deposit and budgeting tools.

Moreover, consider the range of financial products offered. Some digital banks may provide a full suite of services including checking and savings accounts, loans, and investment options, while others may specialize in specific areas.

Finally, prioritize security and customer support. Opt for banks with robust security measures like two-factor authentication and FDIC insurance. Additionally, assess the availability and quality of their customer service channels, whether it’s through phone, email, or live chat.

Future Trends in Digital Banking

The digital banking landscape is continuously evolving, promising to reshape how we manage our finances. Here’s a glimpse into the future:

Hyper-Personalization: Banks will leverage Artificial Intelligence (AI) and data analytics to offer highly customized financial advice and product recommendations, catering to individual needs and goals.

Seamless Integration: Banking services will seamlessly integrate into our daily lives through wearable technology, smart devices, and various platforms, providing unparalleled convenience and accessibility.

Rise of Open Banking: Open banking initiatives will empower customers to share their financial data securely with third-party providers, fostering innovation and competition in financial services.

Enhanced Security: Biometric authentication methods, such as voice and facial recognition, will gain prominence, strengthening security and reducing fraud risk.

Blockchain and Cryptocurrency: Blockchain technology will streamline transactions, enhance security, and facilitate cross-border payments, while cryptocurrencies potentially reshape the future of money management.