In the financial landscape of loans, credit cards, and even apartment rentals, your credit score plays a pivotal role. It’s a three-digit number that represents your creditworthiness, essentially telling lenders how likely you are to repay borrowed money. Understanding what impacts your credit score and how to build a good one is essential for navigating the world of personal finance.

This comprehensive guide will delve into the intricacies of credit scores, demystifying how they’re calculated and why they matter in your financial journey. From the factors that influence your score to practical tips on improving it, we’ll equip you with the knowledge to take control of your credit health and unlock better financial opportunities.

What is a Credit Score?

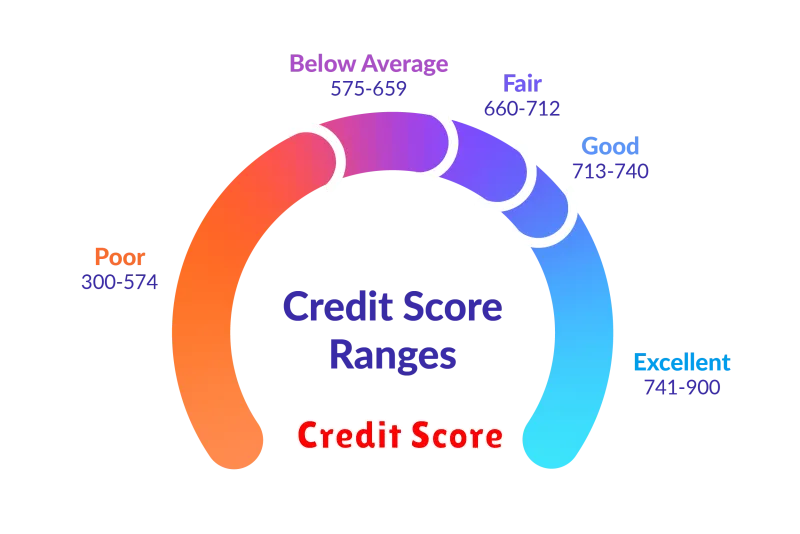

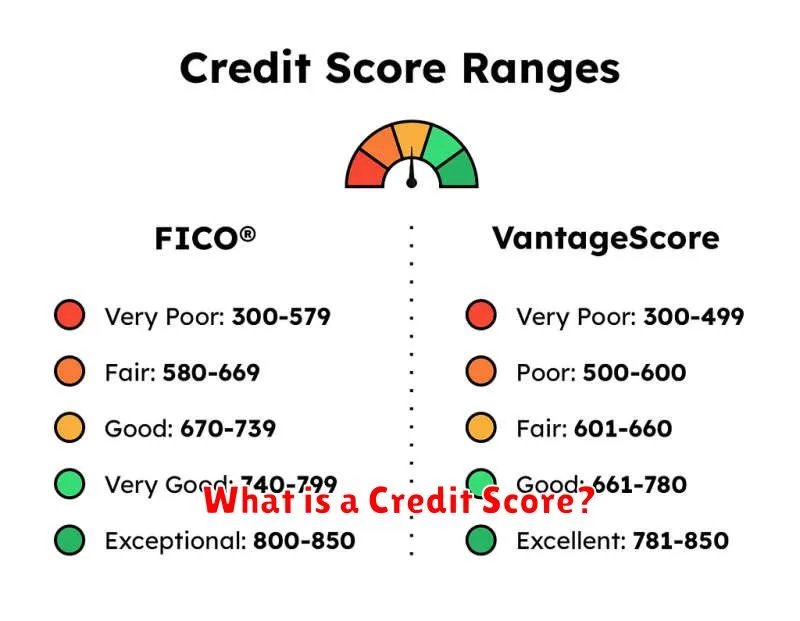

In simple terms, a credit score is a three-digit number that represents your creditworthiness or how likely you are to repay borrowed money responsibly. It’s a snapshot of your financial health based on your credit history.

Think of it like a report card for your finances. Lenders, landlords, and even some employers use your credit score to assess the risk involved in doing business with you. A higher score generally indicates lower risk, making you eligible for better interest rates, loan terms, and rental agreements.

Your credit score is calculated using information from your credit reports, which track your borrowing and repayment activities. Factors like payment history, amounts owed, length of credit history, credit mix, and new credit all contribute to your overall score.

How Credit Scores are Calculated

Credit scores are calculated using a complex formula that takes into account various factors from your credit report. While the exact calculations vary depending on the credit scoring model used, the following factors are typically considered:

1. Payment History (35%): This is the most crucial factor, encompassing your track record of on-time payments for credit cards, loans, utilities, and other bills. Late payments, collections, and bankruptcies negatively impact this category.

2. Amounts Owed (30%): This factor considers how much debt you have in relation to your credit limit (credit utilization ratio) and overall debt levels. Lower utilization and debt levels generally contribute to a higher score.

3. Length of Credit History (15%): A longer credit history with responsible credit management demonstrates stability and positively affects your score.

4. Credit Mix (10%): Having a diverse credit portfolio, including credit cards, installment loans, and mortgages, can indicate responsible credit management and boost your score.

5. New Credit (10%): Opening multiple credit accounts in a short period can lower your score as it suggests increased risk.

The Impact of Your Credit Score on Loans and Interest Rates

Your credit score is a powerful financial tool. It represents your creditworthiness to lenders, illustrating your history of managing debt. A higher score signals responsible financial behavior, making you a more attractive borrower. This translates directly to the interest rates you qualify for and the loan terms you’re offered.

With a good credit score, you’ll gain access to lower interest rates. This means you’ll pay back less money over the life of a loan, saving you potentially thousands of dollars. Whether it’s a mortgage, auto loan, or personal loan, a strong credit score can significantly reduce your borrowing costs.

Conversely, a lower credit score can lead to higher interest rates. Lenders perceive a greater risk when lending to individuals with a history of missed payments or high debt levels. These higher rates result in larger monthly payments and an overall greater expense for the loan. In some cases, a low credit score may even lead to loan applications being denied.

How to Improve Your Credit Score

Boosting your credit score requires consistent effort and responsible financial habits. Here are key steps to take:

1. Make On-Time Payments: Payment history carries significant weight. Consistently paying bills, loans, and credit card balances on time demonstrates financial responsibility and positively impacts your score.

2. Reduce Credit Utilization: Aim to keep your credit utilization ratio (the amount of credit you use compared to your total available credit) low, ideally below 30%. Paying down balances and using credit responsibly can significantly improve this ratio.

3. Build a Positive Credit History: If you have a limited credit history, consider secured credit cards or becoming an authorized user on a responsible friend or family member’s account to establish creditworthiness.

4. Limit New Credit Applications: Avoid applying for multiple credit accounts within a short period, as this can be perceived as risky behavior by lenders and potentially lower your score.

5. Monitor Your Credit Report: Regularly review your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) for errors or inaccuracies. Dispute any discrepancies promptly to ensure your report accurately reflects your credit history.

Common Myths About Credit Scores

There are many misconceptions surrounding credit scores. Understanding how they actually work is crucial for maintaining good financial health. Let’s debunk some common myths:

Myth 1: Checking your credit score hurts it. This is false. Checking your own credit score is considered a “soft inquiry” and does not impact your score.

Myth 2: Closing old credit cards improves your score. This is usually untrue. Closing old cards can shorten your credit history and increase your credit utilization ratio, potentially lowering your score.

Myth 3: Your income determines your credit score. While income influences how much credit you qualify for, it’s not a direct factor in calculating your score.

Myth 4: A single late payment will destroy your credit. While late payments can hurt your score, their impact diminishes over time. One late payment won’t completely ruin your credit, especially if you have a good history otherwise.

Myth 5: You only need one credit score. You actually have multiple credit scores from different credit bureaus. While they’re usually similar, slight variations exist due to differences in data reporting.

By understanding the truth about these common myths, you can make more informed decisions to build and maintain strong credit.

How to Monitor Your Credit Score Regularly

Regularly monitoring your credit score is crucial for maintaining good financial health. It allows you to catch errors, detect potential fraud, and understand the impact of your financial decisions. Here’s how you can stay on top of your credit score:

1. Utilize Free Credit Score Services: Many financial institutions, credit card companies, and online platforms offer free credit score tracking. Take advantage of these services to get a general idea of your creditworthiness.

2. Request Free Annual Credit Reports: You are entitled to one free credit report annually from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Requesting these reports helps you verify the accuracy of your credit history and identify any discrepancies.

3. Consider Paid Credit Monitoring Services: For more comprehensive monitoring, consider subscribing to a paid credit monitoring service. These services provide alerts for changes in your credit report, including hard inquiries, new account openings, and potential fraudulent activity.

4. Set Reminders: It’s easy to forget about checking your credit score, so set reminders in your calendar or phone to review it at least once a month. Regular monitoring enables you to address any issues promptly and maintain a healthy credit history.

The Role of Credit in Financial Planning

Credit plays a pivotal role in financial planning, influencing your ability to achieve various financial goals. It’s not merely about avoiding debt; it’s about strategically using credit to your advantage.

A good credit score translates to lower interest rates on loans, saving you potentially thousands of dollars over the life of the loan, whether it’s a mortgage, auto loan, or personal loan. This translates to more financial flexibility and potentially faster debt repayment.

Beyond loans, credit impacts insurance premiums, rental applications, and even job opportunities in some cases. Landlords and employers often use credit scores as a measure of responsibility and financial stability.

Effectively managing credit involves responsible credit card use, timely bill payments, and monitoring your credit report for inaccuracies. By integrating credit management into your financial plan, you pave the way for financial well-being and a brighter financial future.