Planning for retirement might seem like a distant concern, but the sooner you start, the better. One of the most powerful tools at your disposal is a 401(k) account. This employer-sponsored retirement plan offers significant advantages, including tax benefits and potential employer matching contributions, to help you build a secure future.

This comprehensive guide will walk you through the ins and outs of using your 401(k) effectively. Whether you’re just starting out or looking to maximize your existing savings, we’ll cover everything from contribution strategies and investment options to rollover options and common pitfalls to avoid. Get ready to unlock the full potential of your 401(k) and pave the way for a comfortable and fulfilling retirement.

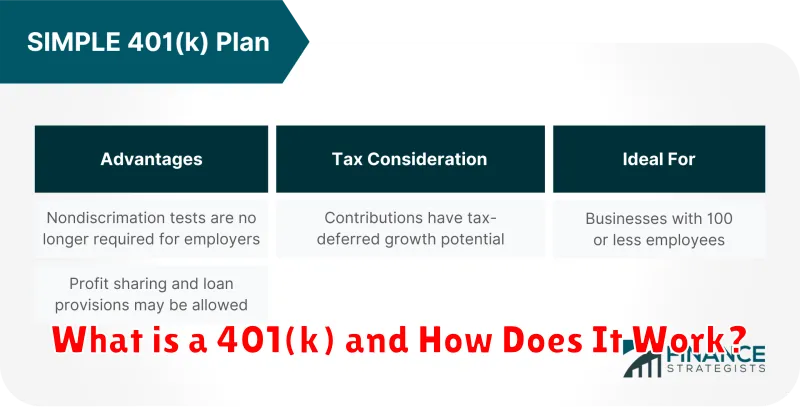

What is a 401(k) and How Does It Work?

A 401(k) is a retirement savings plan sponsored by an employer. It allows employees to contribute a portion of their pre-tax income to a retirement account. This means the money you contribute to your 401(k) is deducted from your paycheck before taxes are taken out, lowering your taxable income for the year.

These contributions are then invested in a range of investment options offered by the plan, typically including mutual funds, stocks, and bonds. The money in your account grows tax-deferred, meaning you won’t owe taxes on your contributions or any earnings until you withdraw the money in retirement.

Many employers also offer a matching contribution to their employee’s 401(k) accounts as an added benefit. This means your employer will match a percentage of your contributions up to a certain limit. For example, your employer might match 50% of your contributions up to 6% of your salary. This employer match is essentially “free money” and can significantly boost your retirement savings.

The Benefits of Contributing to a 401(k)

A 401(k) is a powerful tool for retirement savings, offering numerous benefits that can significantly enhance your financial well-being in your later years. Let’s explore the key advantages of contributing to a 401(k):

Tax Advantages

One of the most compelling reasons to contribute to a 401(k) is the tax advantages it offers. Contributions are made on a pre-tax basis, meaning you contribute a portion of your salary before taxes are deducted. This reduces your taxable income, leading to immediate tax savings.

Employer Matching

Many employers offer matching contributions to their employees’ 401(k) accounts. This is essentially free money that can significantly boost your retirement savings. For instance, if your employer matches 50% of your contributions up to 6% of your salary, and you contribute 6%, your employer will contribute an additional 3%.

Tax-Deferred Growth

Another significant benefit of 401(k) plans is tax-deferred growth. Your investments grow tax-free until you withdraw them in retirement. This allows your money to compound significantly over time, resulting in a larger nest egg.

Potential for Higher Returns

Since 401(k) accounts are designed for long-term savings, you can invest in a diversified portfolio of stocks, bonds, and other assets that have the potential to generate higher returns than traditional savings accounts.

Retirement Readiness

By contributing consistently to a 401(k), you are taking a proactive step towards securing your financial future. The combination of tax advantages, employer matching, tax-deferred growth, and potential for higher returns can significantly enhance your retirement readiness.

How to Choose the Right Investment Options in Your 401(k)

Choosing where to invest your 401(k) contributions can feel overwhelming. This decision directly impacts your retirement savings growth, making it essential to understand your options.

First, consider your risk tolerance. Are you comfortable with the potential for higher returns, even if it means more volatility? Or do you prefer slower, steadier growth with lower risk? Younger investors often lean towards higher risk, while those nearing retirement may prioritize preservation of capital.

Next, familiarize yourself with the investment options in your 401(k). Common choices include:

- Target-date funds: Automatically adjust their asset allocation as you approach retirement.

- Mutual funds: Offer diversification by pooling money from multiple investors to invest in a variety of assets.

- Index funds: Track a specific market index, aiming to match its performance.

- Company stock: Invest directly in the company you work for (use caution with this option).

Diversification is key. Don’t put all your eggs in one basket. Spreading your investments across different asset classes (stocks, bonds, etc.) can help mitigate risk.

Consider using a retirement calculator to estimate how different investment choices might impact your long-term savings. Many financial institutions offer these tools, and they can provide a helpful starting point for your decision-making process.

Finally, don’t be afraid to seek professional advice. A financial advisor can help you create a personalized investment strategy based on your specific circumstances and goals.

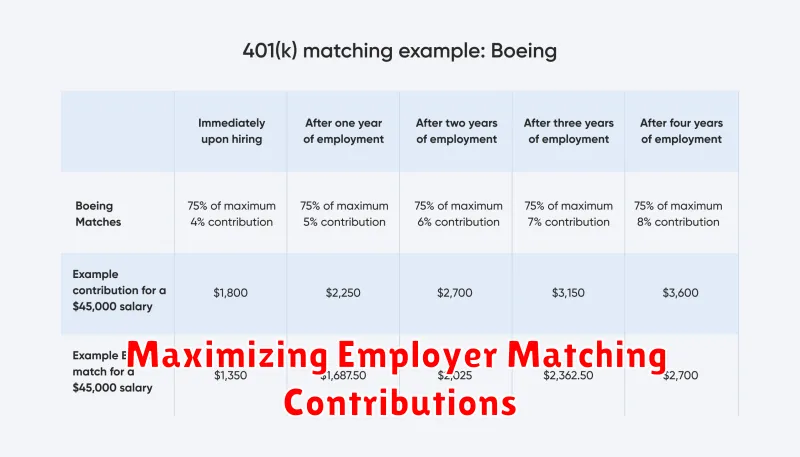

Maximizing Employer Matching Contributions

One of the most effective ways to boost your retirement savings is to take full advantage of your employer’s 401(k) matching contributions. This essentially means free money for your retirement. Here’s how to maximize this valuable benefit:

Understand Your Plan: Employer matches vary, so carefully review your plan documents or consult your HR department. Find out the matching formula (e.g., 50% of your contributions up to 6% of your salary) and the vesting schedule (how long you need to work to own the full match).

Contribute Enough to Get the Full Match: Aim to contribute at least enough to receive the maximum employer match. For example, if your employer matches 100% of contributions up to 4% of your salary, contribute at least 4% to get the full benefit.

Increase Contributions Gradually: If you can’t afford to contribute the full matching amount immediately, start small and gradually increase your contributions over time, such as with each salary raise.

Prioritize Matching Before Other Investments: Think of your employer match as a guaranteed return on your investment. Prioritize maximizing this benefit before allocating funds to other investment opportunities.

The Importance of Diversifying Your 401(k) Investments

Diversification is a vital strategy for maximizing your 401(k) returns and minimizing risk. Putting all your eggs in one basket, even if it seems like a strong performer, can be detrimental to your long-term financial well-being.

When you diversify, you spread your investments across different asset classes like stocks, bonds, and real estate. Within each asset class, you can further diversify by investing in various sectors and industries. This multi-layered approach helps to mitigate losses. If one investment performs poorly, others can potentially offset those losses.

Furthermore, diversification can help you achieve your target asset allocation – the ideal mix of investments based on your risk tolerance, time horizon, and retirement goals. As you approach retirement, rebalancing your portfolio to maintain your desired asset allocation becomes crucial for preserving capital and ensuring you’re on track for a financially secure retirement.

How to Roll Over Your 401(k) When Changing Jobs

Changing jobs is a common occurrence, but it can be confusing to manage your retirement savings during the transition. When you leave your job, you’ll need to decide what to do with your 401(k) account. One of the most common options is to roll it over into another retirement account.

A 401(k) rollover is the process of moving the funds from your old 401(k) to a new retirement account, such as a traditional IRA, Roth IRA, or your new employer’s 401(k) plan. This allows you to keep your retirement savings tax-advantaged and avoid potential penalties.

Direct rollover is the most recommended method, where the funds are transferred directly from your old 401(k) provider to your new account. This method avoids potential tax liabilities and ensures a smooth transfer process.

Before initiating a rollover, compare the fees and investment options of your potential new accounts. Consider factors like investment choices, expense ratios, and any potential restrictions.

Remember to carefully research and compare your options before making a decision. Consult with a financial advisor to determine the best course of action for your specific circumstances.

Common 401(k) Mistakes and How to Avoid Them

A 401(k) is a powerful tool for retirement savings, but it’s easy to make mistakes that can cost you in the long run. Here are some of the most common 401(k) mistakes and how to avoid them:

1. Not Taking Advantage of Your Employer Match. One of the biggest mistakes you can make is not contributing enough to get your full employer match. This is essentially free money, so be sure to contribute enough to get the full amount.

2. Cashing Out When You Change Jobs. It can be tempting to cash out your 401(k) when you change jobs, but this is usually a mistake. You’ll have to pay taxes on the money, and you’ll also miss out on future growth potential. Instead, consider rolling over your 401(k) into an IRA or your new employer’s plan.

3. Investing Too Conservatively. While you don’t want to take on too much risk in your 401(k), investing too conservatively can also hurt your returns. Over time, inflation will erode the value of your savings if you’re not earning a high enough return. Consider a target-date retirement fund or consulting with a financial advisor to find an appropriate asset allocation.

4. Forgetting to Rebalance. As your investments grow, your asset allocation will change. It’s important to rebalance your portfolio periodically to make sure you’re still on track to reach your goals. You can do this by selling some of your winners and reinvesting the money in your laggards.

5. Ignoring Fees. Fees can eat into your returns over time, so it’s important to choose low-cost investment options. Pay attention to expense ratios and other fees when selecting funds for your 401(k).