Want to unlock the best interest rates, secure that dream apartment, or maybe even get a new car loan without the stress? It all starts with building good credit. This comprehensive guide will take you step-by-step through everything you need to know, whether you’re just starting out or looking to rebuild your credit history. We’ll cover the fundamentals of credit scores, explore the factors that impact them, and provide actionable strategies to establish and maintain a positive credit profile.

From understanding credit reports and managing credit cards responsibly to leveraging credit-building tools and avoiding common pitfalls, we’ll equip you with the knowledge and resources needed to achieve your financial goals. Get ready to take control of your finances and unlock a world of possibilities with excellent credit!

What is a Credit Score and Why It Matters?

Your credit score is a three-digit number, typically ranging from 300 to 850, that represents your creditworthiness. It acts as a snapshot of your financial health, giving lenders a quick way to assess the risk of lending you money. The higher your score, the more financially trustworthy you appear to lenders.

This seemingly simple number plays a huge role in your financial life. It can determine your ability to:

- Qualify for credit cards and loans

- Secure favorable interest rates

- Rent an apartment

- Obtain utilities (electricity, gas, etc.)

- Even land a job in certain industries

A good credit score can save you thousands of dollars over your lifetime by qualifying you for lower interest rates and better terms. A poor score, on the other hand, can make it significantly harder to achieve your financial goals.

How to Build Good Credit from Scratch

Building good credit from scratch requires patience and strategic financial behavior. Here’s how to get started:

1. Become an Authorized User: Ask a trusted friend or family member with good credit to add you as an authorized user on their credit card account. Their positive credit history will reflect on your credit report, giving your score a boost.

2. Open a Secured Credit Card: Secured cards require a security deposit, which typically becomes your credit limit. Use the card responsibly and make on-time payments to build a positive payment history.

3. Consider a Credit-Builder Loan: These loans involve borrowing a small amount that’s held in a savings account. You repay the loan in installments, and your payment history is reported to the credit bureaus. Once the loan is repaid, you receive the funds.

4. Get Credit for Rent and Utilities: Services like Experian Boost and UltraFICO allow you to get credit for paying rent and utility bills on time, which can positively impact your credit score.

5. Monitor Your Credit Report: Regularly review your credit report for errors or inaccuracies. Dispute any mistakes to ensure your report accurately reflects your creditworthiness.

Building credit takes time, but by taking these steps, you can establish a positive credit history and work towards achieving your financial goals.

The Do’s and Don’ts of Using Credit Cards

Credit cards can be powerful tools for building credit and managing your finances, but only if used responsibly. Here’s a breakdown of the do’s and don’ts to help you navigate the world of credit cards effectively.

Do’s

Pay your bills on time, every time. This is the most crucial factor in building and maintaining good credit. Set reminders or automate payments to avoid late fees and negative marks on your credit report.

Keep your credit utilization low. This refers to the amount of available credit you’re using. Ideally, aim to keep your balance below 30% of your credit limit. High utilization can signal risk to lenders.

Review your statements regularly. Check for errors, unauthorized transactions, and track your spending habits.

Use credit cards for planned expenses. Utilize cards for purchases you can afford to pay back quickly, like groceries or gas, to build a positive payment history.

Don’ts

Don’t max out your credit cards. Maxing out your cards can hurt your credit score and make it difficult to manage your finances.

Don’t miss payments. Late payments can significantly damage your credit score and lead to late fees.

Don’t apply for too many credit cards at once. Each application triggers a hard inquiry on your credit report, which can temporarily lower your score.

Don’t close old credit cards unless absolutely necessary. Older cards contribute to your credit history length, a factor in your credit score.

How to Check and Monitor Your Credit Score

Checking and monitoring your credit score is crucial for maintaining good financial health. Fortunately, it’s easier than ever to access this information and stay informed about your creditworthiness.

Obtain your free credit report. You are entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually. Request yours at AnnualCreditReport.com, the only authorized website for free reports.

Utilize credit monitoring services. Many financial institutions, credit card companies, and online platforms offer free credit score tracking. These services often provide alerts for changes in your credit report, helping you detect potential errors or fraudulent activities promptly.

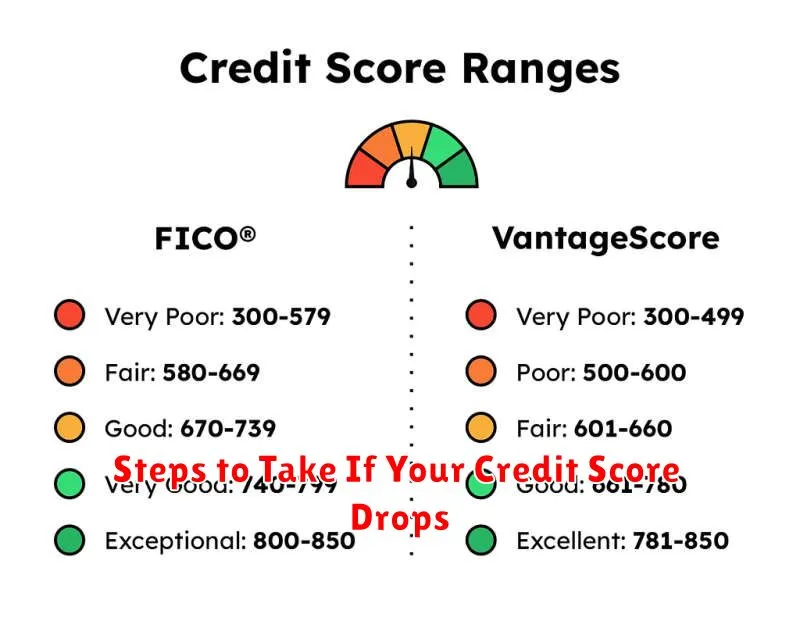

Understand your credit score range. Credit scores typically range from 300 to 850, with higher scores indicating lower credit risk. Familiarize yourself with the different scoring models (FICO and VantageScore) and their respective interpretations.

Review your credit report regularly. Examine your credit report for inaccuracies, such as incorrect personal information or accounts you don’t recognize. Dispute any errors with the respective credit bureau to ensure your credit report accurately reflects your financial history.

By proactively monitoring your credit score, you can identify areas for improvement, protect yourself against identity theft, and make informed financial decisions.

Steps to Take If Your Credit Score Drops

Experiencing a dip in your credit score can be concerning, but it’s important not to panic. Here are some steps you can take to address the issue:

1. Review Your Credit Report: Order a free credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) at AnnualCreditReport.com. Scrutinize each report for errors, inaccuracies, or suspicious activities that could be dragging down your score.

2. Dispute Any Errors: If you identify any errors on your credit report, promptly dispute them with the respective credit bureau. Provide supporting documentation to validate your claim.

3. Identify the Cause: Determine the factors contributing to the score drop. Common culprits include late payments, high credit card balances, applying for new credit, or a change in your credit utilization ratio.

4. Address the Underlying Issues: Once you’ve pinpointed the cause, take immediate action to rectify the situation. If late payments are the issue, prioritize making on-time payments moving forward. If high credit card balances are the problem, create a plan to pay them down strategically.

5. Seek Professional Guidance: If you’re struggling to improve your credit score on your own, consider consulting with a reputable credit counseling agency. They can provide personalized advice and guidance on debt management and credit repair strategies.

How to Dispute Errors on Your Credit Report

Maintaining good credit involves actively monitoring your credit report and promptly addressing any inaccuracies. Discovering errors on your credit report can be frustrating, but it’s essential to remember that you have the right to dispute them.

Begin by obtaining copies of your credit reports from all three major credit bureaus: Experian, Equifax, and TransUnion. You can access free copies of your reports annually through AnnualCreditReport.com. Carefully review each report for any discrepancies, such as incorrect personal information, accounts you don’t recognize, or inaccurate payment histories.

Once you’ve identified an error, gather supporting documentation. This might include a copy of your driver’s license, utility bills, bank statements, or any other relevant documents that validate your claim. Next, contact the credit bureau directly, either online or by mail, and clearly explain the error you’ve found. Provide specific details about the inaccuracy and include copies of your supporting documents.

The credit bureau is legally obligated to investigate your dispute within 30 days (45 days in some cases) and provide you with a written response. If the investigation confirms the error, the credit bureau will correct it and notify the relevant credit furnishers. If the dispute is unsuccessful, you have the right to file a statement of dispute, which will be included in your credit report. This statement allows you to explain your perspective to potential lenders or creditors.

Remember, staying vigilant and proactively addressing errors on your credit report is crucial for maintaining good credit health. By taking the necessary steps to dispute inaccuracies, you can help ensure that your credit report accurately reflects your financial history.

Tips for Maintaining a High Credit Score Over Time

Maintaining a high credit score is an ongoing process that requires diligence and responsible financial habits. Here are some key tips to help you preserve your good credit standing:

1. Make Timely Payments: Payment history is the most crucial factor influencing your credit score. Always pay your bills on time, including credit card bills, loans, utilities, and other recurring expenses. Set up payment reminders or consider automating payments to avoid late fees and negative marks on your credit report.

2. Keep Credit Utilization Low: Your credit utilization ratio, the amount of credit you use compared to your total available credit, significantly impacts your score. Aim to keep your credit utilization below 30%, ideally closer to 10%. Paying down credit card balances in full each month is an effective way to manage utilization.

3. Maintain a Mix of Credit Accounts: Having a diverse credit mix, including credit cards, installment loans (like auto or personal loans), and mortgages, can demonstrate responsible credit management to lenders. However, only take on debt that you need and can comfortably repay.

4. Limit New Credit Applications: Each time you apply for credit, a hard inquiry is generated on your credit report, potentially lowering your score slightly. Only apply for credit when necessary and space out applications over time.

5. Monitor Your Credit Report Regularly: Regularly review your credit report from all three major credit bureaus (Experian, Equifax, and TransUnion) to check for errors, discrepancies, or signs of identity theft. You can access your credit reports for free annually from AnnualCreditReport.com.

6. Be Patient and Consistent: Building and maintaining excellent credit takes time and consistent effort. Be patient, stick to responsible financial habits, and your credit score will reflect your efforts in the long run.