Navigating the complexities of financial matters within a relationship can be a significant source of stress. Whether you’re just starting a relationship or have been together for years, establishing clear financial boundaries is essential for a healthy and harmonious partnership. Without these boundaries, disagreements about money can escalate into major conflicts, potentially jeopardizing the entire relationship.

This article will delve into the importance of setting financial boundaries, exploring the benefits for both individuals and the relationship as a whole. We’ll cover practical tips for initiating conversations about money, addressing common financial challenges couples face, and establishing a system that promotes financial transparency and mutual respect.

Why Financial Boundaries are Important in Relationships

Financial boundaries are a crucial aspect of any healthy relationship. They provide clarity and prevent misunderstandings that can lead to conflict and resentment. By establishing clear financial expectations, couples can build a foundation of trust, respect, and mutual understanding when it comes to their finances.

Setting financial boundaries allows each individual to maintain a sense of autonomy and control over their own money. This is especially important when partners have different financial habits and goals. For instance, one person may be a saver, while the other is a spender. Having clear boundaries helps ensure that both individuals feel comfortable and respected in their financial decisions.

Furthermore, financial boundaries facilitate open communication about money. This includes discussing financial goals, concerns, and expectations. By being transparent and honest, couples can avoid surprises and disagreements down the line. Regular money conversations help to keep both partners informed and on the same page, fostering a stronger and more stable relationship.

Discussing financial boundaries with your partner is crucial for a healthy and successful relationship. It’s about finding a comfortable balance that respects both individuals’ financial autonomy and shared goals. Here’s how to navigate this conversation:

1. Choose the Right Time and Place: Don’t spring this conversation up out of the blue. Select a time when you’re both relaxed, free from distractions, and in a positive headspace.

2. Start with Open Communication: Approach the conversation with honesty and empathy. Express your desire to establish financial clarity for the benefit of your relationship. Encourage your partner to share their thoughts and feelings openly as well.

3. Define Individual and Shared Financial Goals: Discuss your individual financial aspirations and obligations. Do you prioritize saving for a house, paying off debt, or early retirement? Align on shared financial goals, such as a dream vacation or a down payment on a home.

4. Determine Financial Responsibility: Decide how you’ll manage joint expenses. Will you split bills evenly, proportionally based on income, or use a different system? Discuss individual financial responsibilities, such as personal spending habits and debt repayment.

5. Establish Boundaries and Expectations: Clearly outline your financial boundaries. Discuss limits on spending, investment decisions, and lending or borrowing money. Set realistic expectations for financial transparency and accountability.

6. Regularly Review and Adjust: Financial situations and goals can change, so it’s essential to revisit your financial boundaries periodically. Have open and honest conversations about any adjustments needed as your lives evolve.

Remember, the key to successful financial conversations with your partner is open communication, mutual respect, and a willingness to compromise. By proactively addressing financial boundaries, you can strengthen your relationship and create a more secure financial future together.

Setting Joint Financial Goals and Boundaries

Setting joint financial goals is a crucial step in fostering a healthy and successful financial partnership. Start by having open and honest conversations about your individual aspirations, such as buying a home, saving for retirement, or taking a dream vacation.

Once you’ve identified your shared goals, create a plan to achieve them together. This might involve establishing a joint budget, determining how much each person will contribute towards shared expenses, and setting up a savings plan.

Equally important is setting financial boundaries within the relationship. This includes deciding how much financial independence each person will maintain. Will you have separate bank accounts or a joint account? How will you handle large purchases? By clearly defining your boundaries and expectations, you can minimize potential conflicts and build a stronger financial foundation for your relationship.

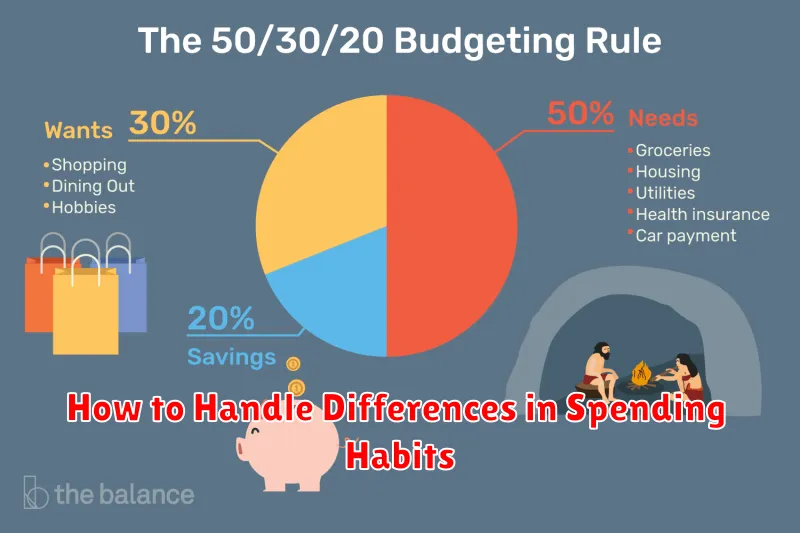

How to Handle Differences in Spending Habits

One of the most common challenges couples face when establishing financial boundaries is navigating different spending habits. One partner might be more frugal, while the other enjoys spending more freely. This difference can lead to conflict and resentment if not addressed openly and respectfully.

Communication is key. Start by having an honest conversation about your individual spending habits, financial goals, and what money represents for each of you. Listen actively to understand your partner’s perspective, and try to find common ground.

Consider setting a budget together. This allows you to track spending, identify areas where you can compromise, and ensure you’re both working towards shared financial objectives. Within the budget, you can allocate a specific “fun money” amount that each person can spend however they choose, no questions asked. This can provide a sense of autonomy and reduce arguments over smaller purchases.

Remember that compromise is essential. You might not always agree on every purchase, and that’s okay. The goal is to find a sustainable system that respects both partners’ needs and values. If disagreements arise, address them constructively, focusing on finding solutions rather than placing blame.

The Role of Transparency in Financial Boundaries

Transparency forms the bedrock of successful financial boundaries within a relationship. It involves openly and honestly communicating about individual financial situations, habits, and goals. This includes discussing income, debts, spending habits, and long-term financial aspirations.

When both partners have a clear understanding of the financial landscape, it fosters trust and allows for collaborative decision-making. Open communication helps manage expectations, avoids misunderstandings, and prevents resentment from festering over unspoken financial concerns.

Transparency extends to the ongoing management of finances. It means being open about individual spending, joint expenses, and any financial decisions that impact the relationship. By proactively sharing information and discussing any concerns, couples can maintain healthy financial boundaries and nurture a stronger, more secure partnership.

How to Respect and Maintain Financial Boundaries Over Time

Respecting financial boundaries in a relationship requires ongoing effort and open communication. Consistency is key – stick to the agreed-upon arrangements to build trust and avoid confusion. Regularly review and adjust your financial boundaries as needed. Relationships evolve, and so do financial situations, goals, and responsibilities. Communicate openly and honestly about any changes in income, expenses, or financial goals that might affect your existing boundaries.

Don’t shy away from difficult conversations. Address any breaches or disagreements respectfully and promptly. Remember that flexibility is also important. Life throws curveballs, and unexpected expenses can arise. Be understanding and willing to adjust boundaries temporarily if needed, while still maintaining open communication and mutual respect.

Finally, celebrate your successes! Acknowledge and appreciate each other’s efforts in respecting the established boundaries. This reinforces the importance of your financial agreement and contributes to a healthier and more harmonious financial relationship.

Common Challenges in Setting Financial Boundaries and How to Overcome Them

Setting financial boundaries in any relationship can be challenging, even when both parties have the best intentions. Here are some common obstacles you might face and how to navigate them:

Challenge #1: Fear of conflict. Many people avoid discussing money due to a fear of arguments or discomfort.

Solution: Approach the conversation with empathy and a collaborative spirit. Frame it as a way to strengthen your relationship and achieve shared financial goals.

Challenge #2: Differing financial values and habits. One person might be a spender while the other is a saver, leading to disagreements and tension.

Solution: Communicate openly and honestly about your financial priorities, habits, and goals. Seek common ground and compromise where necessary. Consider separate accounts for individual spending while maintaining a joint account for shared expenses.

Challenge #3: Guilt and pressure. One partner might feel guilty for spending “too much” or pressured to contribute beyond their comfort level.

Solution: Establish clear expectations and agreements about financial responsibilities. Remember that each person’s financial situation and comfort level are valid. Focus on open communication and mutual respect.

Challenge #4: Lack of communication. Avoiding financial conversations altogether can lead to misunderstandings and resentment down the line.

Solution: Schedule regular money dates to discuss finances, track spending, and review budgets. Be honest about your financial situation and communicate any concerns openly.

Remember, setting healthy financial boundaries is an ongoing process that requires communication, compromise, and respect. By addressing these challenges head-on, you can build stronger, more financially secure relationships.