Planning for the unexpected might not be the most pleasant thought, but it is undeniably crucial. A well-structured will is vital, ensuring your assets are distributed according to your wishes. Without one, your loved ones may face legal complexities and potential conflicts during an already difficult time. This guide will delve into the compelling reasons why establishing a will is essential, outlining the benefits and providing a clear path towards securing your family’s future.

Whether you have substantial assets or a modest estate, this guide offers valuable insights into the estate planning process. From understanding the different types of wills to navigating probate and exploring alternatives like trusts, we’ll equip you with the knowledge to make informed decisions. Take control of your legacy and gain peace of mind knowing your loved ones are protected – let’s explore why having a will is a cornerstone of responsible financial planning.

What is Estate Planning?

Estate planning is the process of managing and protecting your assets while you’re alive, and ensuring their distribution according to your wishes after your death. It involves creating a comprehensive plan that considers all your financial and personal matters, aiming to provide for your loved ones and minimize potential conflicts or financial burdens in the future.

This process encompasses a range of legal documents and strategies, including wills, trusts, power of attorney, and healthcare directives. It’s about gaining control over your legacy and ensuring that your final wishes are respected, providing peace of mind for both you and your heirs.

The Importance of Having a Will

A will is a legal document that outlines your wishes for the distribution of your assets and the care of your minor children (if any) after your death. Having a will is crucial regardless of your age or financial situation. It ensures that your loved ones are taken care of according to your wishes and helps prevent potential conflicts and legal battles among family members.

Without a will, your estate will be subject to the laws of intestacy, which vary by state. This means that the court will decide how your assets are distributed, and this may not align with your intentions. Having a will gives you control over your legacy and provides peace of mind knowing that your affairs are in order.

How to Create a Will: Step-by-Step Guide

Creating a will might seem daunting, but it’s a crucial step in ensuring your wishes are honored and your loved ones are taken care of after you’re gone. Here’s a step-by-step guide to simplify the process:

1. Gather Information: Begin by compiling a list of your assets, including real estate, bank accounts, investments, and personal belongings. Also, identify your beneficiaries (individuals or organizations you wish to inherit your assets).

2. Choose a Type of Will: Research different types of wills, such as testamentary wills (traditional written documents), living wills (for healthcare decisions), and pour-over wills (used with trusts). Consult an attorney to determine the best option for your needs.

3. Appoint Key Roles: Select an executor (person responsible for carrying out your will’s instructions), a guardian for minor children (if applicable), and a trustee to manage any trusts established in your will.

4. Detail Your Wishes: Clearly state how you want your assets distributed among your beneficiaries. Be specific about who inherits what to avoid any confusion or disputes later.

5. Draft and Review: While you can create a basic will yourself, it’s highly recommended to consult an estate planning attorney. They can ensure your will is legally sound, tailored to your specific circumstances, and minimizes potential complications.

6. Sign and Witness: Your will must be signed and dated in the presence of at least two witnesses, who must also sign the document. Requirements for witnesses may vary by state, so consult local laws.

7. Store Safely and Update: Keep your will in a secure location, inform your executor of its whereabouts, and provide copies to trusted individuals. Review your will periodically, especially after major life events like marriage, divorce, or the birth of a child, and make updates as needed.

The Role of Executors and Beneficiaries

When creating a will, understanding the roles of executors and beneficiaries is crucial. The executor is the person you appoint to manage your estate after you pass away. Their responsibilities include:

- Identifying and collecting your assets.

- Paying off any outstanding debts and taxes.

- Distributing the remaining assets to your beneficiaries as instructed in your will.

Beneficiaries, on the other hand, are the individuals or entities who will inherit your assets. You can name anyone as a beneficiary, including family members, friends, charities, or trusts.

Choosing the right executor and clearly outlining your beneficiaries ensures your final wishes are fulfilled and your loved ones are taken care of.

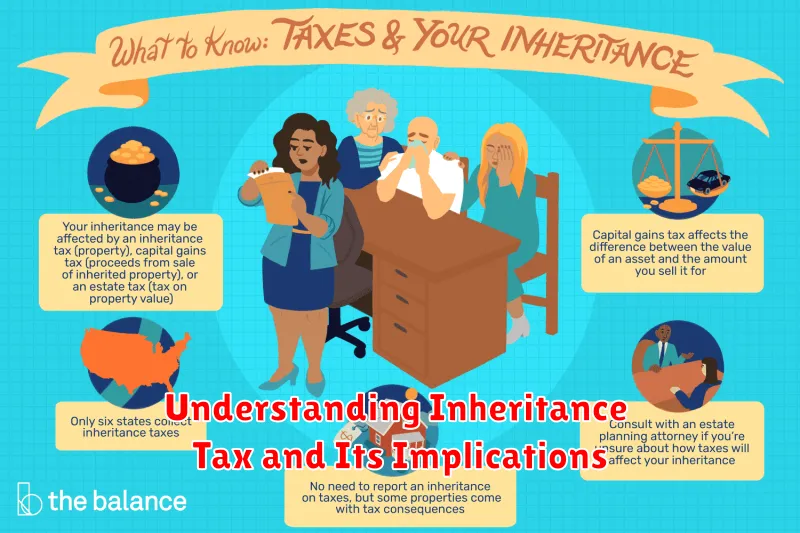

Understanding Inheritance Tax and Its Implications

Inheritance tax, also known as estate tax, is a tax levied on the value of a deceased person’s estate. This tax is imposed on the right to transfer property after death and varies significantly by jurisdiction. Some jurisdictions have no inheritance tax, while others have a progressive system where higher value estates are taxed at higher rates.

Understanding the implications of inheritance tax is crucial for effective estate planning. A significant tax burden can erode the value of the inheritance intended for beneficiaries. Therefore, it is essential to understand the rules and regulations governing inheritance tax in your jurisdiction and explore strategies to potentially mitigate its impact.

Common Mistakes to Avoid in Estate Planning

Estate planning is a crucial aspect of financial planning that many people often overlook. Failing to plan for the distribution of your assets can lead to unintended consequences for your loved ones. To ensure a smooth transition and minimize potential conflicts, it’s essential to avoid common estate planning mistakes.

One of the most significant mistakes is failing to create a will altogether. Without a will, your state’s intestacy laws will dictate how your assets are distributed, which may not align with your wishes.

Another common error is not updating your estate plan regularly. Life events such as marriage, divorce, the birth of a child, or the death of a beneficiary necessitate a review and potential modification of your estate plan to reflect your current circumstances.

Many individuals make the mistake of choosing the wrong executor or trustee. Selecting someone trustworthy, capable, and willing to take on this responsibility is paramount. It’s also crucial to communicate your wishes clearly to your chosen representative.

Failing to consider potential taxes is another common pitfall. Estate taxes can significantly impact the value of your assets passed on to your heirs. Consulting with a financial advisor or estate planning attorney can help you explore strategies to minimize potential tax liabilities.

Lastly, neglecting to communicate your estate plan with your beneficiaries can lead to confusion and disputes. Discussing your wishes and the reasoning behind them can prevent misunderstandings and ensure a smoother transition.

By avoiding these common mistakes and seeking professional guidance, you can create a comprehensive estate plan that reflects your wishes and protects your loved ones’ financial well-being.

How Often Should You Update Your Will?

You should review your will every 3-5 years and update it whenever significant life changes occur. This ensures your wishes are accurately reflected and minimizes potential complications during estate settlement.

Here are some situations that warrant a will update:

- Marriage or divorce

- Birth or adoption of a child

- Death of a beneficiary or executor

- Significant changes in assets or financial situation

- Moving to a different state

Regularly reviewing and updating your will offers peace of mind knowing your loved ones are taken care of according to your current wishes.