Are you looking for a reliable and effective way to grow your wealth? Do terms like “stock market” and “investing” seem daunting and complex? Investing in index funds might be the perfect solution for you. Index funds offer a simplified, low-cost entry point into the world of investing, allowing you to potentially build wealth over time without needing to become a financial expert.

This article will delve into the compelling reasons why you should consider starting your index fund investment journey today. We’ll explore the benefits they offer over individual stock picking, discuss their potential for long-term growth, and provide you with the information you need to make informed investment decisions. Whether you’re a seasoned investor or just starting, understanding index funds can be a game-changer for securing your financial future.

What are Index Funds?

An index fund is a type of mutual fund or exchange-traded fund (ETF) with a portfolio constructed to match or track the components of a market index, such as the S&P 500. Instead of a fund manager actively picking individual stocks or bonds, index funds follow a set of rules or a specific market index.

Think of an index fund as a pre-built portfolio that represents a particular market segment. For example, an S&P 500 index fund would hold stocks of all 500 companies listed in the S&P 500 index, in roughly the same proportions. This makes index funds a form of passive investing, aiming to mirror the market’s performance rather than trying to outperform it.

How Index Funds Work

Index funds are designed to track the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. Instead of trying to pick individual stocks, index funds simply hold all (or a representative sample) of the securities included in the chosen index.

Here’s how it works: Let’s say you invest in an S&P 500 index fund. This fund will hold shares of all 500 companies listed in the S&P 500, mirroring the index’s composition. As the value of the underlying companies in the index rises or falls, so does the value of your index fund investment.

Passively managed is a key characteristic of index funds. Unlike actively managed funds where a fund manager actively selects and trades stocks, index funds require minimal trading. This passive approach results in lower management fees, making them a cost-effective investment option.

When you invest in an index fund, you’re essentially buying a small ownership stake in all the companies represented by the index. This diversification is a significant advantage, as it spreads your risk across a broad range of assets, reducing the impact of any single company’s performance on your overall portfolio.

Benefits of Investing in Index Funds

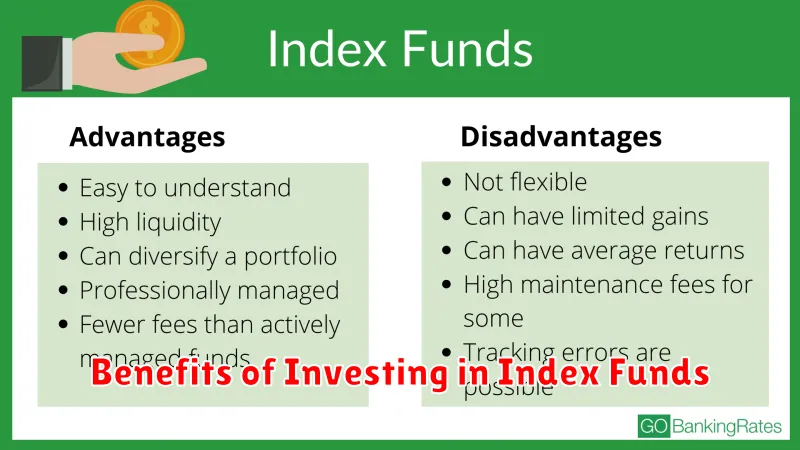

Investing in index funds offers a multitude of benefits, making them a compelling option for both novice and seasoned investors. Here’s why you should consider adding index funds to your portfolio:

Diversification: Index funds track a specific market index, such as the S&P 500, instantly diversifying your investments across a basket of stocks or bonds. This diversification mitigates risk as your portfolio isn’t reliant on the performance of a single security.

Low Costs: Index funds typically have lower expense ratios compared to actively managed funds. Since they passively track an index, they require less management, translating into cost savings that directly benefit your investment growth.

Simplicity: Index funds provide a straightforward approach to investing. You’re essentially investing in the overall performance of a market sector or the entire market, simplifying your investment decisions.

Long-Term Growth Potential: Historically, index funds have demonstrated competitive returns over the long term. While past performance doesn’t guarantee future results, index funds offer the potential for growth aligned with the underlying market’s performance.

Tax Efficiency: Index funds are generally tax-efficient investments. Their passive management style leads to fewer taxable events, allowing your investments to potentially grow more efficiently.

How to Choose the Best Index Fund for Your Portfolio

Picking the right index funds is crucial for a successful investment strategy. Here’s what to consider:

1. Investment Goals: Are you investing for retirement, a down payment, or something else? Your goal will determine your time horizon and risk tolerance, influencing your index fund choices.

2. Market Capitalization: Index funds can track large-cap, mid-cap, or small-cap stocks. Large-cap stocks are generally considered less risky, while small-cap stocks offer higher growth potential.

3. Sector: You can choose index funds that focus on specific sectors like technology, healthcare, or energy, allowing you to tailor your investments to your market outlook.

4. Geography: Consider investing in international index funds in addition to domestic ones to diversify your portfolio globally.

5. Expense Ratio: Index funds are known for their low fees, but expense ratios still vary. Choose funds with low expense ratios to maximize your returns.

6. Tracking Error: This measures how closely the index fund tracks its underlying index. Look for funds with low tracking errors.

By carefully evaluating these factors, you can choose the best index funds to align with your investment goals and risk tolerance.

Comparing Index Funds with Mutual Funds

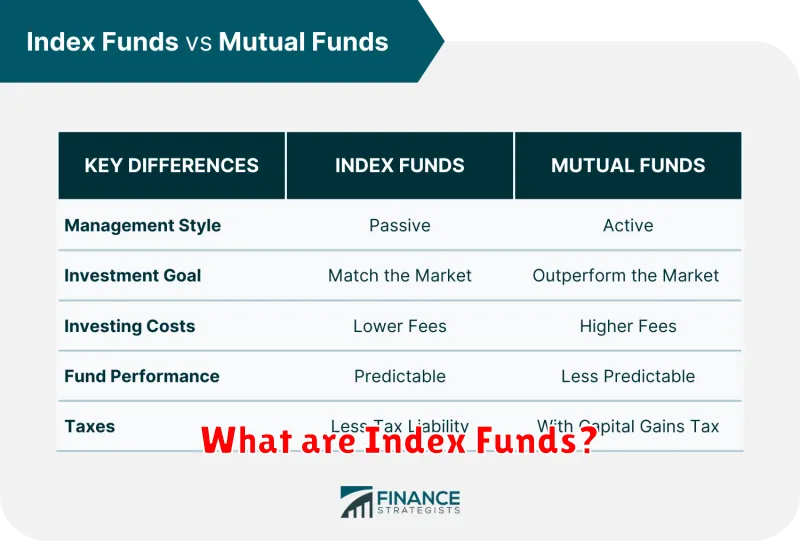

Both index funds and mutual funds are popular investment vehicles that allow you to pool your money with other investors. However, they differ in their investment approach and fee structures. Understanding these differences is crucial in making informed investment decisions tailored to your financial goals.

Index funds are designed to track a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. They passively replicate the index by holding the same securities in the same proportions. This passive approach translates to lower management fees as the fund manager is not actively picking stocks.

On the other hand, mutual funds are actively managed by portfolio managers who select stocks and bonds with the aim of outperforming the market. This active management comes at a higher cost, reflected in higher expense ratios compared to index funds. While the goal of active management is to beat the market, it’s important to note that consistently outperforming the market is challenging.

In summary, index funds offer a low-cost, diversified way to invest in the stock market, aligning with the market’s performance. Mutual funds, while potentially offering higher returns, come with higher fees and no guarantee of outperforming the market. Your choice between the two should depend on your risk tolerance, investment goals, and the time horizon you have for investing.

How to Get Started with Index Fund Investing

Jumping into the world of index fund investing is surprisingly straightforward. First, you’ll need to choose a brokerage account. There are many options available, both online and traditional, each with varying fee structures and investment minimums. Consider your investing goals and budget when making your choice.

Next, decide on the specific index fund that aligns with your investment strategy. Do you want to track the S&P 500? A global market index? Research different options and their historical performance to find the right fit.

Finally, set up a regular investment schedule. This could be monthly, quarterly, or whatever works for you. By automating your investments, you take advantage of dollar-cost averaging, which helps mitigate the impact of market fluctuations.

Common Misconceptions About Index Funds

Despite their growing popularity, index funds are often misunderstood. Let’s debunk some common misconceptions:

Misconception 1: Index Funds are Boring/Only for Beginners. Some believe index funds lack the excitement of actively managed funds. However, index funds provide steady, long-term growth aligned with market performance, suitable for both seasoned and new investors.

Misconception 2: Index Funds Mean Settling for Average Returns. Index funds aim to match the market, not beat it. While it’s true you won’t outperform the market, you also won’t underperform it. This strategy offers consistent returns over time, often outpacing actively managed funds in the long run.

Misconception 3: All Index Funds are the Same. Index funds can track different market indexes (S&P 500, Nasdaq, etc.) and have varying expense ratios. It’s crucial to research and choose funds aligned with your financial goals and risk tolerance.