In today’s economic climate, making your money work for you is more important than ever. You might think a regular savings account is just a place to store your money, but did you know there are ways to make it grow faster? That’s right, you can actually earn a decent return on your savings without taking on a lot of risk.

This article dives deep into “How to Make the Most of Your Savings Account: Tips for Higher Returns.” We’ll explore the best strategies to maximize your interest earnings, uncover high-yield savings accounts that often outperform traditional options, and equip you with the knowledge to make informed financial decisions and watch your savings climb.

Understanding How Savings Accounts Work

A savings account is a fundamental financial tool designed to help you store your money safely while earning a little extra through interest. When you deposit money into a savings account, you’re essentially lending it to the bank or financial institution. In return, they pay you interest on the amount you’ve deposited.

The interest you earn is calculated based on an annual percentage yield (APY). The higher the APY, the more interest you earn on your savings. APY takes into account the frequency of interest compounding, which is how often the earned interest is added back to your principal balance, allowing you to earn interest on your interest.

Key features of savings accounts to remember are:

- Liquidity: You can typically access your funds easily, making them suitable for short-term savings goals and emergencies.

- FDIC Insurance: In the US, savings accounts at most banks are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per insured bank, providing peace of mind that your money is safe.

While savings accounts generally offer lower returns compared to investment accounts, they play a crucial role in building a solid financial foundation by keeping your money safe and accessible while helping it grow steadily over time.

Different Types of Savings Accounts and Their Benefits

Not all savings accounts are created equal. Understanding the different types can help you maximize your returns. Here’s a breakdown:

1. Traditional Savings Accounts

Offered by most banks and credit unions, these accounts provide a safe place to store your money while earning a modest amount of interest. They typically come with ATM cards or check-writing privileges for easy access to your funds.

2. High-Yield Savings Accounts

These accounts function similarly to traditional savings accounts but typically offer significantly higher interest rates. They’re often offered by online banks or credit unions, which have lower overhead costs to pass on to customers as higher yields.

3. Money Market Accounts (MMAs)

MMAs typically offer higher interest rates than traditional savings accounts and may come with check-writing privileges. However, they might have higher minimum balance requirements to earn the best rates.

4. Certificates of Deposit (CDs)

CDs require you to deposit a fixed amount of money for a predetermined period, ranging from a few months to several years. In exchange for locking up your funds, you’ll earn a fixed interest rate that’s typically higher than savings accounts or MMAs. However, you’ll face penalties for early withdrawals.

Choosing the right savings account depends on your individual needs and financial goals. Consider factors like accessibility, interest rates, and potential fees when making your decision.

How to Choose the Best Savings Account for Your Needs

Finding the right savings account is the cornerstone of maximizing your returns. With a plethora of options available, it’s crucial to pinpoint the features that align with your financial goals.

First and foremost, examine the Annual Percentage Yield (APY). This figure represents the interest earned on your deposits over a year. A higher APY equates to greater earnings. Don’t hesitate to compare rates from various institutions, including traditional banks and online banks, as they often offer more competitive APYs.

Next, delve into the account fees. Some banks impose monthly maintenance fees, minimum balance requirements, or withdrawal limits. These fees can eat into your earnings, so opt for accounts with minimal or no fees whenever possible.

Consider your accessibility needs. Do you prioritize the convenience of a physical branch, or are you comfortable managing your savings exclusively online? Online banks typically offer higher APYs but lack brick-and-mortar branches.

Finally, evaluate the bank’s reputation and security measures. Look for institutions with strong financial ratings and robust online security protocols to safeguard your hard-earned savings.

By carefully considering these factors, you can select the best savings account to help you achieve your financial aspirations and maximize your returns.

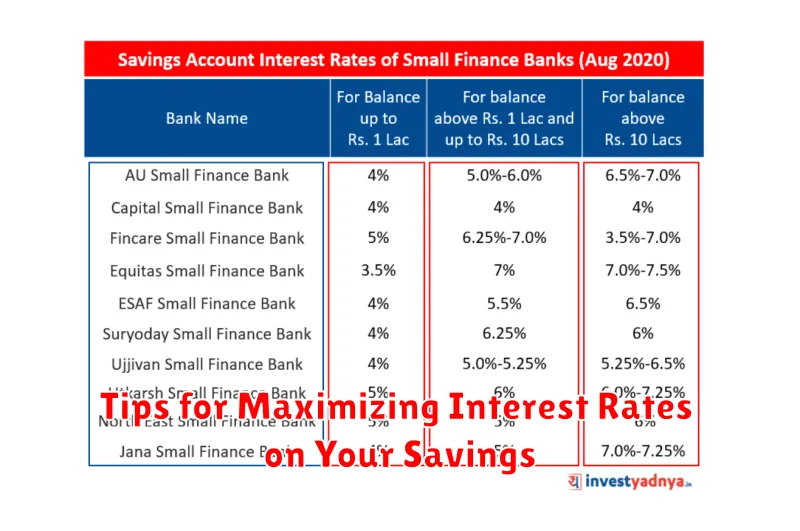

Tips for Maximizing Interest Rates on Your Savings

In today’s economic landscape, making your money work for you is more crucial than ever. While saving is essential, simply parking your hard-earned cash in a low-yield account won’t help you reach your financial goals effectively. To truly maximize your savings, you need to be strategic about where you store your money and how you leverage interest rates. Here are some proven tips to help you achieve higher returns on your savings:

1. Explore High-Yield Savings Accounts: Don’t settle for the paltry interest rates offered by traditional brick-and-mortar banks. Consider opening a high-yield savings account with an online bank or credit union. These institutions often provide significantly better interest rates due to lower overhead costs.

2. Shop Around and Compare Rates: Interest rates can vary widely between financial institutions. Make it a habit to regularly compare rates from different banks and credit unions. Utilize online comparison tools to simplify this process and identify the best options available.

3. Consider Money Market Accounts (MMAs): MMAs typically offer higher interest rates than regular savings accounts while providing similar liquidity. They often require a higher minimum balance but can be a good option for parking larger sums of money.

4. Look into Certificates of Deposit (CDs): If you’re comfortable locking your money away for a fixed period, CDs can provide even higher interest rates than savings accounts or MMAs. The catch is that you’ll typically face penalties for early withdrawals.

5. Take Advantage of Compounding: Compounding is the magic of earning interest on your interest. The more frequently your interest compounds (e.g., daily, monthly), the faster your savings will grow. Look for accounts with frequent compounding periods.

6. Minimize Fees: Be mindful of fees that can eat into your earnings. Some accounts may charge monthly maintenance fees, ATM fees, or excessive transaction fees. Choose accounts with minimal or no fees to maximize your returns.

By following these tips, you can make your savings work harder for you and achieve your financial goals faster. Remember to regularly review your savings strategy and adapt as needed based on market conditions and your financial circumstances.

The Role of Savings Accounts in Your Financial Plan

A savings account is a fundamental element of a sound financial plan. It serves as a safe and accessible repository for your money, providing a foundation for financial stability and growth. While savings accounts may not offer the highest returns compared to other investment options, their security and liquidity make them indispensable for various financial goals.

Primarily, savings accounts excel in providing an emergency fund. Life is unpredictable, and having 3 to 6 months’ worth of living expenses readily available can provide a crucial safety net during unexpected events such as job loss or medical emergencies.

Furthermore, savings accounts are ideal for short-term financial goals. Whether you’re saving for a down payment on a house, a dream vacation, or a new car, a savings account allows you to set aside funds and earn interest while keeping your money easily accessible when you need it.

While savings accounts play a crucial role in financial security and short-term savings goals, it’s essential to remember that their low-risk nature often translates to lower returns. Therefore, they are not ideal for long-term wealth building. However, as a cornerstone of a comprehensive financial plan, savings accounts provide a solid foundation for achieving your financial aspirations.

How to Avoid Fees and Penalties on Your Savings Account

Keeping your hard-earned money shouldn’t cost you anything. To make the most of your savings account and avoid unnecessary fees and penalties, follow these simple tips:

Understand Your Bank’s Fee Schedule: Carefully review the fee schedule provided by your bank. Pay close attention to common fees like monthly maintenance fees, minimum balance requirements, excessive withdrawal fees, and inactivity fees.

Meet Minimum Balance Requirements: Many savings accounts have minimum balance requirements to avoid monthly fees. Ensure you maintain the required balance to steer clear of these charges.

Limit Withdrawals: Federal regulations often limit certain types of withdrawals from savings accounts to six per month. Exceeding this limit can result in excessive withdrawal fees. Be mindful of your withdrawal frequency.

Maintain Account Activity: Some banks impose inactivity fees on dormant accounts. Make occasional deposits or withdrawals, even small ones, to demonstrate account activity and avoid these fees.

Explore Fee Waivers: Inquire about potential fee waivers. Some banks offer waivers for students, seniors, or customers who maintain multiple accounts.

By understanding and proactively managing your savings account, you can avoid unnecessary fees and ensure your money works as hard for you as possible.

Alternatives to Traditional Savings Accounts for Higher Returns

While traditional savings accounts offer security and FDIC insurance, their interest rates often pale in comparison to other investment vehicles. If you’re aiming for higher returns, consider these alternatives:

High-Yield Savings Accounts: Offered by online banks and credit unions, these accounts typically boast higher interest rates than traditional counterparts, though rates are still variable.

Money Market Accounts (MMAs): MMAs offer variable interest rates often tied to market conditions, potentially yielding higher returns than basic savings. However, they might come with limited withdrawal options.

Certificates of Deposit (CDs): CDs require you to lock in your savings for a fixed period at a fixed interest rate. While this limits liquidity, it often guarantees a higher return than standard savings, especially over time.

Investment Options: Explore options like bonds, index funds, or real estate, which carry higher risks but offer the potential for more significant returns compared to traditional savings accounts.