Retirement might seem far off, but planning for it shouldn’t be. Retirement planning is crucial for ensuring a financially secure future, allowing you to enjoy your golden years without financial stress. Whether you’re just starting your career or approaching retirement age, understanding the fundamentals of saving and investing is paramount.

This comprehensive guide, “Retirement Planning 101: How to Secure Your Future Financially”, will provide a step-by-step roadmap to help you navigate the complexities of retirement planning. We’ll cover essential topics like determining your retirement goals, creating a budget, exploring various investment options, and understanding retirement accounts. By taking control of your financial future today, you can pave the way for a comfortable and fulfilling retirement tomorrow.

Why Retirement Planning is Crucial

Retirement planning is not just about saving money for a comfortable life after work; it’s about securing your financial future and ensuring you can maintain your desired lifestyle without relying solely on others. Here’s why it’s crucial:

Financial Security: Retirement planning provides a financial safety net, allowing you to cover living expenses, healthcare costs, and unexpected financial emergencies without depleting your savings or relying on others for support.

Inflation Protection: The cost of living tends to rise over time due to inflation. Retirement planning helps you stay ahead of inflation by growing your savings at a rate that outpaces the rising cost of goods and services.

Longer Lifespans: People are living longer, which means your retirement savings need to last longer. A well-structured retirement plan ensures you have sufficient funds to support yourself throughout your retirement years, no matter how long they may be.

Maintaining Lifestyle: Retirement shouldn’t mean sacrificing your lifestyle. Planning allows you to continue enjoying hobbies, travel, and other activities you love without financial constraints.

Peace of Mind: Perhaps most importantly, retirement planning provides peace of mind. Knowing you’ve taken the necessary steps to secure your financial future reduces stress and allows you to fully enjoy your retirement years.

How to Calculate How Much You’ll Need for Retirement

Determining your retirement income needs is a crucial first step in planning for a financially secure future. While the magic number varies based on individual circumstances, the process starts with understanding your projected expenses.

Begin by estimating your annual expenses in retirement. Consider factors like housing, healthcare, travel, and lifestyle choices. Factor in inflation to ensure your calculations remain relevant over time. Next, subtract any sources of income you anticipate receiving, such as Social Security or pension payments.

The resulting figure represents your estimated annual retirement income needs. To determine the total savings goal, consider your estimated life expectancy and factor in potential investment growth. Various online retirement calculators can help you with these complex calculations, providing a clearer picture of your savings target.

Remember, this is a simplified overview, and seeking advice from a qualified financial advisor is recommended for personalized guidance tailored to your specific situation.

Best Retirement Accounts and How to Choose One

Planning for retirement is crucial to securing your financial future. A key aspect of this is choosing the right retirement account that aligns with your financial goals and risk tolerance.

There are several types of retirement accounts available, each with its own set of advantages and disadvantages. The most common ones include:

- 401(k) Plans: Offered by employers, these accounts allow pre-tax contributions, potentially reducing your current taxable income. Some employers offer matching contributions, providing “free” money towards your retirement.

- Traditional IRA: This account allows pre-tax contributions, offering potential tax deductions in the present. Your money grows tax-deferred, and you pay taxes upon withdrawal during retirement.

- Roth IRA: Unlike Traditional IRAs, contributions are made after-tax, meaning you won’t get an immediate tax deduction. However, withdrawals during retirement are tax-free, potentially saving you money in the long run.

- SEP IRA: Designed for self-employed individuals and small business owners, SEP IRAs allow for larger contributions compared to Traditional or Roth IRAs.

Choosing the best retirement account depends on several factors. Consider your employment status (employed or self-employed), your risk tolerance (conservative or aggressive), and your current vs. future income expectations. For example, if you anticipate being in a higher tax bracket during retirement, a Roth IRA might be more beneficial. However, if you need tax relief now, a Traditional IRA or 401(k) could be a better fit.

Researching and comparing different retirement account options is essential. Speaking with a financial advisor can provide personalized guidance tailored to your specific circumstances and retirement goals.

The Importance of Starting Early with Retirement Savings

Starting early with retirement savings is critical for securing a comfortable financial future. The power of compound interest is a key factor. Compound interest allows your money to grow exponentially over time, meaning your earnings generate even more earnings. The earlier you start, the longer your money has to grow, leading to a significantly larger nest egg by retirement.

Starting early also reduces the burden of catching up later. Delaying saving means you’ll need to contribute significantly more each month to reach your retirement goals. By starting early, even small contributions can accumulate substantially, making retirement planning less stressful and more manageable.

Diversifying Your Retirement Portfolio

A comfortable retirement doesn’t happen by chance. It requires careful planning and a strategic approach to managing your savings. One of the most crucial aspects of retirement planning is diversifying your retirement portfolio.

Diversification involves spreading your investments across different asset classes, such as:

- Stocks (Equities)

- Bonds (Fixed Income)

- Real Estate

- Commodities (e.g., gold, oil)

The goal is to reduce your overall risk. When one asset class isn’t performing well, others may be, which can help cushion your portfolio against significant losses. For example, if the stock market experiences a downturn, a diversified portfolio that includes bonds might be less affected.

How you diversify depends on several factors, including your:

- Risk tolerance

- Time horizon (years until retirement)

- Financial goals

It’s wise to consult with a qualified financial advisor who can assess your individual circumstances and guide you toward a diversified portfolio that aligns with your retirement objectives.

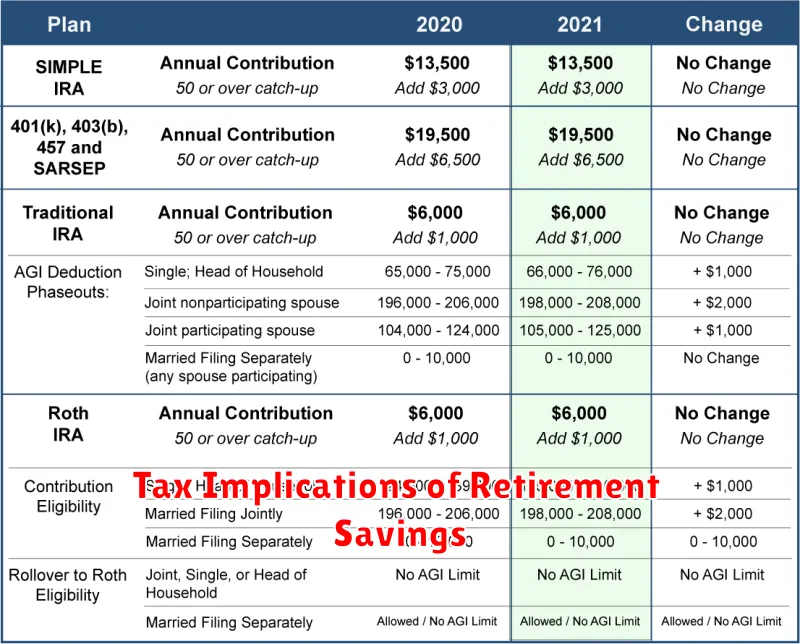

Tax Implications of Retirement Savings

Understanding the tax implications of your retirement savings is crucial for maximizing your financial security in retirement. Different retirement savings plans come with varying tax advantages, and knowing how these work can significantly impact your long-term wealth.

Traditional 401(k)s and Traditional IRAs offer tax-deductible contributions, meaning you can reduce your taxable income for the year you make the contribution. However, your withdrawals in retirement will be taxed as ordinary income.

On the other hand, contributions to Roth 401(k)s and Roth IRAs are made with after-tax dollars, meaning you won’t receive an immediate tax deduction. The significant advantage here is that your qualified withdrawals in retirement are completely tax-free.

It’s essential to consider your current income, expected tax bracket in retirement, and long-term financial goals when choosing between these options. Consulting with a financial advisor can provide personalized guidance tailored to your specific circumstances.

Common Mistakes to Avoid in Retirement Planning

Retirement planning is crucial for a financially secure future, but many people make mistakes that can jeopardize their golden years. By understanding these pitfalls, you can avoid them and set yourself up for a more comfortable retirement.

One common mistake is starting too late. The power of compounding means that the earlier you start saving, the more time your money has to grow. Even small contributions made consistently over time can accumulate significantly.

Another mistake is underestimating expenses. Many people fail to account for inflation, healthcare costs, and other potential expenses that can arise in retirement. It’s essential to create a realistic budget and factor in these costs to avoid financial strain later on.

Lack of diversification is another pitfall. Putting all your eggs in one basket, such as relying solely on Social Security or a single investment, can be risky. Diversifying your portfolio across different asset classes can help mitigate risk and protect your savings.

Furthermore, ignoring debt can have a significant impact on your retirement. High-interest debt can eat away at your savings and make it challenging to maintain your lifestyle. Prioritize paying down debt before and during retirement to free up more cash flow.

Finally, not having a plan is a recipe for disaster. Without a comprehensive retirement plan, you’re essentially leaving your future to chance. Develop a clear plan that outlines your goals, income sources, expenses, and investment strategy.

By avoiding these common mistakes, you can increase your chances of achieving a comfortable and financially secure retirement. Remember to start early, budget realistically, diversify your investments, manage debt, and seek professional guidance when needed.