In the realm of personal finance, setting financial goals is paramount to achieving financial stability and realizing your aspirations. Whether it’s buying a dream home, retiring comfortably, or securing your children’s education, having well-defined financial objectives provides a roadmap for your financial journey. Without clear goals, it’s easy to fall into the trap of impulsive spending and financial stagnation.

This article will delve into the profound significance of setting financial goals and provide a comprehensive guide on how to set them effectively. We’ll explore the benefits of goal setting, the different types of financial goals, and provide actionable steps to help you define your goals, create a plan, and stay motivated throughout the process.

The Importance of Setting Financial Goals

Setting financial goals is a crucial aspect of financial well-being. It provides direction and motivation for your financial decisions, helping you make informed choices and stay focused on what matters most to you.

Without clear financial goals, it’s easy to overspend, accumulate debt, and miss out on opportunities to build wealth. Having well-defined goals allows you to track your progress, measure your success, and make necessary adjustments along the way. Whether it’s saving for a down payment on a house, paying off student loans, or retiring comfortably, financial goals provide a roadmap to help you achieve your aspirations and secure your financial future.

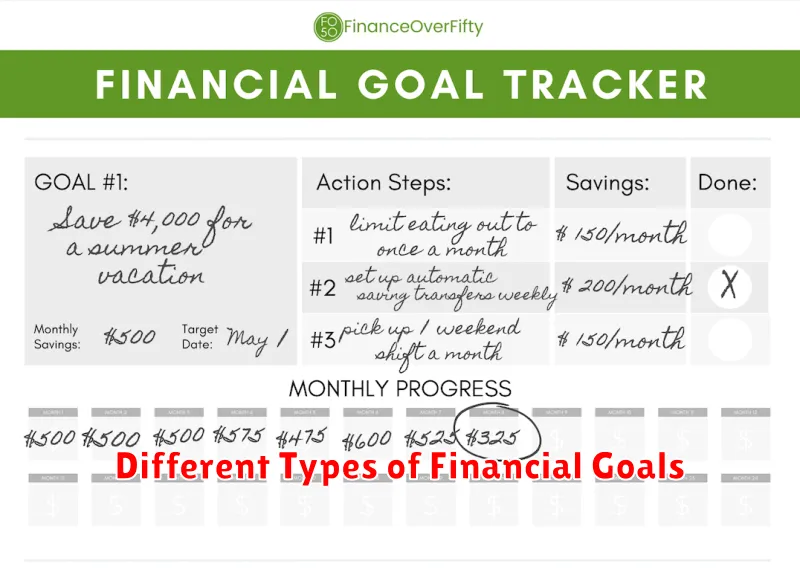

Different Types of Financial Goals

Financial goals can be categorized based on the time horizon you set to achieve them. Understanding these different types helps you prioritize and strategize effectively.

Short-Term Goals are objectives you aim to achieve within a year. These might include:

- Building an emergency fund

- Paying off credit card debt

- Saving for a vacation

Mid-Term Goals typically span 1 to 5 years and require more planning and saving. Examples include:

- Down payment for a home

- Funding a child’s education

- Major home renovation

Long-Term Goals demand significant time, often 5+ years, and may involve substantial financial resources. Common long-term goals are:

- Retirement planning

- Investment portfolio growth

- Leaving a legacy/inheritance

It’s important to have a mix of all three types of goals to maintain financial stability and progress towards your aspirations. Remember, your financial goals are personal and should reflect your values and priorities.

How to Prioritize Your Financial Goals

Once you’ve identified your financial goals, it’s crucial to prioritize them effectively. Not all goals hold the same weight, and some require more immediate attention than others. Here’s a step-by-step guide on how to prioritize your financial goals:

1. Categorize Your Goals: Divide your goals into short-term (achievable within a year), mid-term (1-5 years), and long-term (5+ years) categories. This helps visualize the timeline for each goal.

2. Consider Urgency and Importance: Urgent and Important: These are high-priority goals that require immediate action, like paying off high-interest debt or building an emergency fund. Important but Not Urgent: Goals like saving for retirement or a down payment on a house fall into this category. Urgent but Not Important: These might include smaller purchases or wants that can be delayed. Neither Urgent nor Important: These goals can be set aside for now.

3. Rank Within Categories: Once categorized, rank goals within each category from highest to lowest priority. For instance, within short-term goals, paying off a high-interest credit card might take precedence over saving for a vacation.

4. Align with Your Values: Ensure your financial goals align with your personal values. If you prioritize experiences over material possessions, allocate more funds towards travel and less towards luxury items.

5. Be Flexible and Adapt: Life throws curveballs. Be prepared to adjust your priorities as your circumstances change. Regularly review and re-evaluate your goals to stay on track.

Creating a Financial Plan to Achieve Your Goals

A financial plan acts as your roadmap to achieving your financial goals. It provides a structured approach to managing your money, allocating resources effectively, and tracking your progress. Here’s a step-by-step process to create a solid financial plan:

1. Assess Your Current Financial Situation: Begin by understanding where you stand financially. Calculate your net worth (assets minus liabilities), track your income and expenses, and review your credit report.

2. Set SMART Financial Goals: Define your goals using the SMART criteria: Specific, Measurable, Achievable, Relevant, and Time-bound. For example, instead of “Save more money,” set a goal like “Save $5,000 for a down payment on a car within 2 years.”

3. Create a Budget: Develop a realistic budget that aligns with your goals. Track your income and allocate funds for essential expenses (housing, food, transportation) and savings. Prioritize your spending based on your goals.

4. Establish an Emergency Fund: Set aside 3 to 6 months’ worth of living expenses in an easily accessible account. This fund provides a financial cushion for unexpected events.

5. Manage Debt Effectively: Create a plan to pay down high-interest debts, such as credit card balances. Explore debt consolidation or balance transfer options to reduce interest payments.

6. Invest for the Future: Determine your risk tolerance and explore investment options to grow your wealth over time. Consider retirement accounts (401(k), IRA), stocks, bonds, and mutual funds.

7. Review and Adjust Regularly: Your financial plan is not static. Revisit and adjust it at least annually or when significant life changes occur (e.g., marriage, job change, having children).

Monitoring Your Progress Towards Financial Goals

Setting financial goals is only half the battle; consistently monitoring your progress is crucial to staying motivated and reaching your objectives. Regularly reviewing your finances allows you to track your advancement, identify any roadblocks, and make necessary adjustments to your plan.

Establish a system for tracking your progress, whether it’s a spreadsheet, budgeting app, or a simple notebook. Update your records regularly, ideally monthly, noting your income, expenses, savings, and debt payments. Visualizing your progress through charts or graphs can be incredibly motivating.

During your review sessions, celebrate your successes, no matter how small. Acknowledge and reward yourself for milestones reached, reinforcing positive financial behaviors. At the same time, analyze any setbacks or challenges you encounter. Don’t be afraid to adjust your timeline, strategies, or even the goal itself if circumstances change or you find yourself veering off track.

Remember, achieving financial goals is a marathon, not a sprint. Regularly monitoring your progress keeps you focused, adaptable, and ultimately increases your chances of reaching your desired financial destination.

Adjusting Your Goals as Life Changes

Life is rarely static. New jobs, relationships, family situations, and even global pandemics can significantly impact your financial landscape. That’s why it’s crucial to view your financial goals not as rigid mandates, but as living, breathing entities that adapt alongside you.

Regularly revisit and reassess your goals. Has your income increased, allowing you to reach your savings goal faster? Have unexpected expenses cropped up, requiring you to adjust your timeline or prioritize differently? By remaining flexible and making adjustments as needed, you ensure your goals remain relevant and achievable, keeping you motivated and on track towards financial well-being.

Don’t be afraid to make significant changes if necessary. Life throws curveballs, and sometimes a complete overhaul of your financial plan might be needed. Maybe you’ve started a family and now prioritize saving for college, or perhaps a career change necessitates a shift in your investment strategy. Embrace these changes as opportunities for growth and tailor your financial goals to align with your evolving priorities and aspirations.

Tools to Help You Stay on Track

Staying motivated and tracking your progress is crucial for achieving your financial goals. Luckily, a variety of tools can assist you in this journey:

Budgeting Apps: Apps like Mint, YNAB (You Need a Budget), and Personal Capital offer real-time insights into your income, expenses, and progress towards your goals. They automate tracking and provide visual representations of your finances, making it easier to stay organized and accountable.

Spreadsheets: For those who prefer a hands-on approach, spreadsheets are excellent for creating personalized budgets, tracking investments, and forecasting financial outcomes.

Goal-Setting Apps: Apps like Habitica and Strides gamify the process of setting and achieving goals, including financial ones. They offer rewards, progress tracking, and a sense of community to keep you motivated.

Financial Advisors: Consider consulting with a financial advisor for personalized guidance and support. They can help you develop a comprehensive financial plan, choose suitable investments, and make informed decisions aligned with your goals.

Accountability Partners: Share your goals with a trusted friend, family member, or mentor who can provide encouragement, support, and hold you accountable.

Remember that the most effective tools are the ones you’ll consistently use. Experiment with different options and find what works best for your needs and preferences.