In today’s fast-paced world, managing your finances can feel like a full-time job. Between tracking spending, budgeting, investing, and planning for the future, it’s easy to feel overwhelmed. Luckily, there’s a solution! Financial apps have exploded in popularity, offering powerful tools to help you take control of your money and achieve your financial goals.

Whether you’re looking to budget more effectively, invest your savings, pay down debt faster, or simply gain a clearer picture of your overall financial health, there’s an app designed to make your life easier. This article will explore the top financial apps you should be using to simplify your finances and make smarter money decisions.

Why You Should Use Financial Apps

In today’s digital age, managing your finances has never been easier (or more important!). Financial apps provide a convenient, centralized, and often free way to take control of your money. Here’s why you should consider incorporating them into your life:

Track Spending & Budgeting: Most apps automatically categorize transactions from linked accounts, giving you a crystal-clear picture of where your money goes. This makes it simple to identify areas for potential savings and stick to a budget.

Financial Goals & Savings: Many apps go beyond basic tracking, allowing you to set financial goals (like a down payment or vacation) and track your progress. Some even offer automated savings features, putting money aside so you don’t have to think about it.

Investing & Growing Your Wealth: A growing number of apps cater to beginner investors, offering low-cost or even free trading options. Even if you’re not ready to invest, these apps can help you learn the basics and explore your options.

Security & Fraud Protection: Reputable financial apps prioritize the security of your data, often with features like two-factor authentication and encryption. Many also provide real-time transaction alerts, helping you spot potential fraud quickly.

Stay Organized & Reduce Financial Stress: With all your financial information in one place, you can ditch the shoebox of receipts and spreadsheets. Financial apps offer a clear, organized overview, making tax time less stressful and helping you stay on top of bills and due dates.

Overall, financial apps provide a powerful suite of tools to help you manage your money effectively, reach your financial goals, and gain peace of mind.

Best Budgeting Apps for Personal Finance Management

Managing your finances effectively is crucial for achieving your financial goals. Luckily, numerous budgeting apps are designed to simplify this process and empower you to take control of your money. Here’s a look at some of the best budgeting apps available:

Mint is a comprehensive budgeting app that offers a wide range of features, including expense tracking, budgeting, bill payment reminders, and credit score monitoring. Its user-friendly interface and integration with various financial institutions make it a top choice for many.

YNAB (You Need a Budget) is a popular budgeting app that utilizes the zero-based budgeting method. This approach encourages users to allocate every dollar of their income to specific expenses or savings goals, ensuring that all funds are accounted for.

PocketGuard simplifies budgeting by automatically tracking your income and expenses, categorizing transactions, and setting spending limits. It also provides insights into your spending habits and helps you identify areas where you can save money.

Personal Capital caters to users with more complex financial needs. In addition to budgeting features, it offers investment tracking, retirement planning tools, and the option to connect with a financial advisor.

Wally is an excellent option for those seeking a simple and intuitive budgeting app. It allows you to track your income and expenses, set budgets, and monitor your progress towards your financial goals. Its visual representation of your spending habits can be particularly helpful.

Ultimately, the best budgeting app for you will depend on your individual needs and preferences. Consider factors such as ease of use, features offered, and pricing when making your decision. By utilizing a budgeting app, you can gain valuable insights into your finances and make more informed decisions about your money.

Apps to Track Your Expenses Effortlessly

Keeping a close eye on your spending is crucial for effective money management. Fortunately, there are numerous apps designed to make expense tracking effortless and even a little bit enjoyable. These apps can help you:

- Identify spending habits: By automatically categorizing your transactions, these apps provide valuable insights into where your money is going.

- Set and stick to budgets: Many apps allow you to set spending limits for different categories, sending alerts when you’re nearing your limit.

- Achieve financial goals: Whether it’s saving for a down payment or paying off debt, expense tracking apps can help you stay motivated and on track.

Some popular expense tracking apps include Mint, Personal Capital, and YNAB (You Need a Budget). These apps connect to your bank accounts, credit cards, and investment accounts to provide a comprehensive view of your finances. They also offer features such as bill payment reminders, investment tracking, and personalized financial advice.

By automating the tedious task of expense tracking, these apps free up your time and mental energy, allowing you to focus on other aspects of your financial well-being.

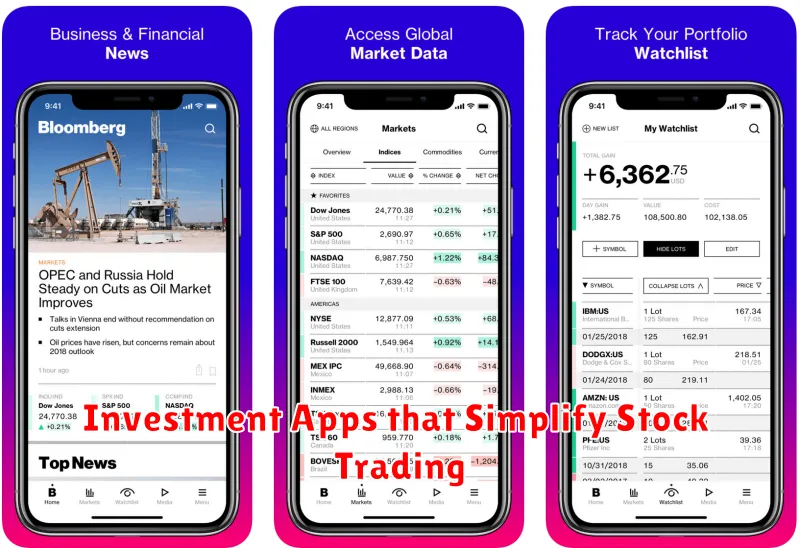

Investment Apps that Simplify Stock Trading

In today’s digital age, managing your finances and building a strong investment portfolio is easier than ever thanks to the rise of investment apps. These apps provide user-friendly interfaces and tools that make investing accessible to everyone, from beginners to seasoned traders.

These apps typically offer features like fractional shares, allowing you to invest in companies with high share prices even on a budget. They also often have educational resources to help you learn the basics of investing or explore advanced trading strategies.

When choosing an investment app for stock trading, consider factors like fees (such as trading commissions and account maintenance fees), investment options, research tools, and security features. Look for an app that aligns with your investment goals and risk tolerance, and always conduct thorough research before making any financial decisions.

How to Choose the Right Financial App for Your Needs

In today’s digital age, managing your finances has never been easier thanks to the plethora of financial apps available. However, with so many options, choosing the right app for your specific needs can feel overwhelming. This is where a strategic approach is needed.

Start by identifying your core financial goals. Are you primarily looking to budget better, track expenses, save for a specific goal, or invest your money? Different apps specialize in different areas, so understanding your priorities is crucial.

Next, consider the features that are most important to you. Do you need automatic expense tracking, bill payment reminders, or investment advice? Some apps offer a comprehensive suite of features, while others focus on specific aspects of personal finance.

Security should be paramount when choosing a financial app. Look for apps that use strong encryption, multi-factor authentication, and have a solid reputation for protecting user data. Reading user reviews can provide valuable insights into an app’s security track record.

Finally, don’t underestimate the importance of user experience. The best financial app is one that you find intuitive, easy to use, and visually appealing. A well-designed app can make managing your finances feel less like a chore and more like a step towards achieving your financial goals.

Security Concerns with Financial Apps

While financial apps offer incredible convenience, it’s crucial to be aware of the security risks involved. Here are some key concerns:

Data Breaches: Like any app that handles sensitive information, financial apps are targets for hackers. A breach could expose your financial details, including account numbers, passwords, and transaction history.

App Vulnerabilities: Some apps may have security flaws that hackers can exploit to gain unauthorized access to your data. It’s important to choose apps from reputable developers with a strong track record of security.

Device Security: If your smartphone is lost or stolen, someone could potentially access your financial apps if you haven’t enabled strong security measures like PINs, biometrics, or two-factor authentication.

Phishing Scams: Be wary of fake apps disguised as legitimate financial apps. These apps are designed to steal your login credentials. Always download apps from official app stores and double-check the developer’s information.

Future Trends in Financial Technology

The financial technology landscape is constantly evolving, driven by innovation and changing consumer demands. Several key trends are poised to shape the future of how we manage our finances.

Artificial Intelligence (AI) and Machine Learning (ML) are set to revolutionize financial services. AI-powered chatbots can offer personalized financial advice, while ML algorithms can analyze spending patterns to provide tailored recommendations and even automate savings.

Blockchain technology, beyond its association with cryptocurrencies, offers potential in areas like secure payments, faster transaction settlements, and enhanced fraud prevention.

The rise of Open Banking, where financial institutions allow access to consumer data through APIs, is fostering greater competition and innovation. This can lead to more personalized and integrated financial services.

Finally, expect to see a continued focus on financial inclusion. Fintech companies are developing solutions to cater to the unbanked and underbanked populations, providing them access to essential financial tools.

These trends paint an exciting picture of the future of finance, one where managing money is more efficient, personalized, and accessible than ever before.