Compound interest is often called the eighth wonder of the world, and for good reason. It’s a powerful force that can turn small, consistent investments into significant wealth over time. Understanding how compound interest works is essential for anyone looking to grow their money for the long term, whether it’s for retirement, a down payment on a home, or a child’s education.

This article will delve into the mechanics of compound interest, explore its incredible potential to multiply your investments, and provide practical tips on how to harness its power. We’ll discuss key factors that influence its growth, such as interest rate, investment timeframe, and the magic of compounding frequency. Get ready to unlock the secrets of building wealth through the magic of compounding!

What is Compound Interest?

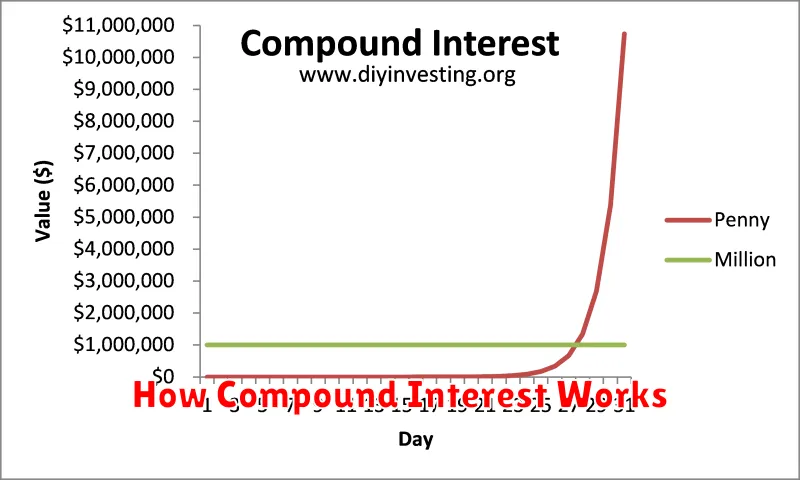

Compound interest is the principle of earning interest on your initial investment, as well as on any interest earned previously. In simpler terms, it’s “interest on interest,” which can lead to exponential growth of your money over time.

Imagine you invest $1,000 in an account that earns a 10% annual interest rate. After the first year, you earn $100 in interest, bringing your total to $1,100. In the second year, you earn interest on the new principal of $1,100, not just the original $1,000. This means you earn $110 in interest in the second year. This cycle continues, with your interest earnings compounding year after year.

The key takeaway is that with compound interest, you’re not just earning a return on your initial investment, but also on the accumulated interest. This snowball effect is what makes compound interest a powerful force in wealth building, particularly over the long term.

How Compound Interest Works

Compound interest is often called “interest on interest,” and it’s the key to building wealth over time. Here’s how it works: When you invest your money, it earns interest. With compound interest, that earned interest is added back to your principal.

For example: Let’s say you invest $1,000 at a 5% annual interest rate. After the first year, you earn $50 in interest. With compound interest, in the second year, you earn interest on the new principal of $1,050 (your original investment plus the earned interest). This cycle continues, with your interest earnings compounding over time.

The longer you leave your money invested, the more powerful the effect of compounding becomes. Time is your greatest ally when it comes to compound interest, allowing your investments to potentially grow significantly. This is why starting early with investing is so important.

The Impact of Compound Interest on Long-Term Investments

Compound interest is a powerful force in investing, especially over long periods. Essentially, it’s the concept of earning interest on your initial investment as well as on any interest earned previously. This snowball effect can lead to significant growth over time.

The longer your money compounds, the more pronounced the impact becomes. A small sum invested in your 20s can grow exponentially by retirement age, thanks to the magic of compound interest. This highlights the importance of starting early with your investments.

To illustrate, imagine investing $1,000 at a 7% annual return. After the first year, you’d earn $70 in interest. In year two, you earn interest on the original $1,000, plus the $70 earned, resulting in slightly more than $70 in interest. This cycle continues, with the amount of interest earned increasing each year.

Patience is key with compound interest. While the initial growth might seem slow, the power of compounding truly reveals itself over decades, not years. This makes long-term investing strategies particularly effective in building wealth.

Examples of Compound Interest in Action

Seeing compound interest in action can help solidify its significance. Here are a few examples:

Example 1: Investing in the Stock Market

Imagine you invest $10,000 in a stock market index fund that yields an average annual return of 7%. With compound interest, you earn returns not only on your initial investment but also on the accumulated earnings from previous years. Over 30 years, your investment could grow to over $76,000, even without additional contributions. This demonstrates how compounding can significantly amplify your returns over the long term.

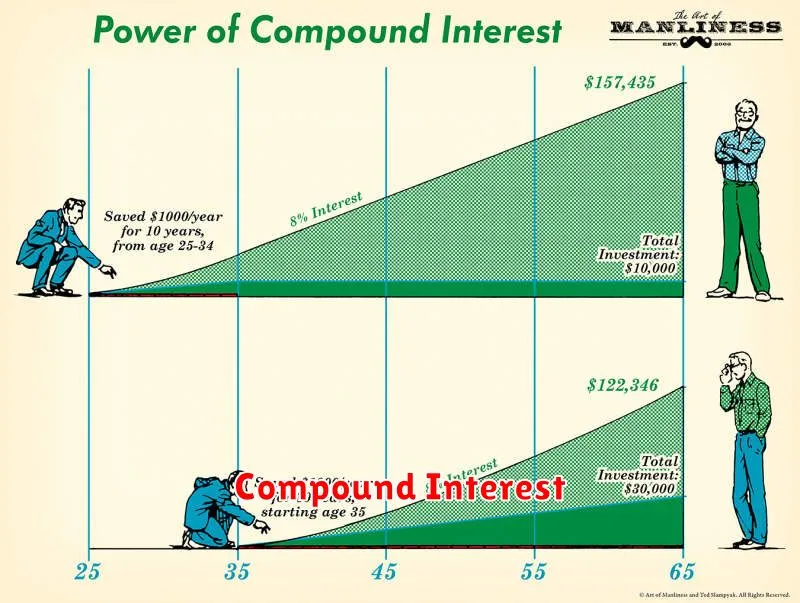

Example 2: The Power of Starting Early

Consider two individuals, both aiming to save $1 million by retirement. Person A starts investing $5,000 annually at age 25, while Person B starts investing $10,000 annually at age 35. Assuming a consistent 7% return, Person A will likely reach the $1 million goal earlier, despite contributing less overall. This highlights the advantage of time in compounding – the earlier you start, the more your money can potentially grow.

Example 3: Debt and Compound Interest

Compound interest can also work against you, especially with debt. For instance, if you have a credit card balance of $5,000 with a 20% interest rate, and you only make minimum payments, it can take years to pay off the debt, and you’ll end up paying significantly more in interest. This exemplifies how compound interest can lead to a cycle of debt if not managed responsibly.

These examples demonstrate the potential of compound interest to work for you when investing and the importance of managing debt to prevent it from working against you.

How to Calculate Compound Interest

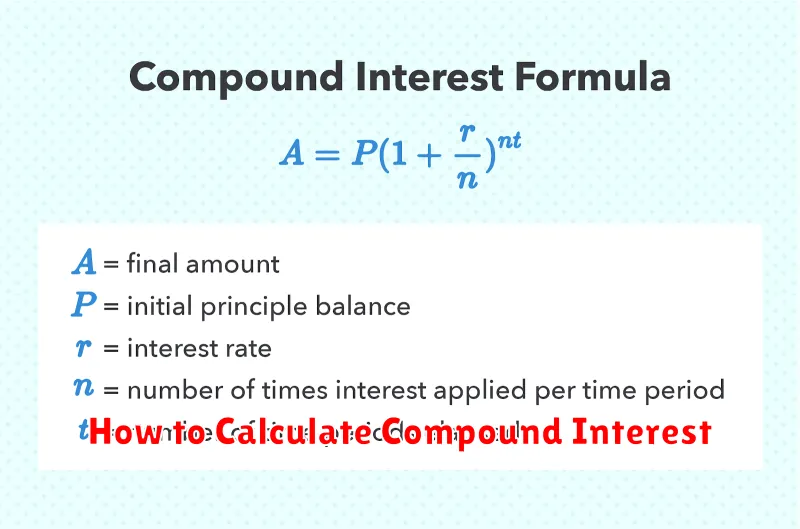

Compound interest might seem like a mystery, but understanding how to calculate it can empower your investment decisions. The formula itself is straightforward:

A = P (1 + r/n)^(nt)

Let’s break down what each element represents:

- A: This is the final amount you’ll have in your account, including the initial investment and the accumulated interest.

- P: This stands for “principal,” which is the original amount of money you invested.

- r: This is the annual interest rate expressed as a decimal. For example, 5% interest would be 0.05.

- n: This represents the number of times interest is compounded per year. If it’s compounded monthly, n would be 12.

- t: This is the time in years that your money is invested.

By plugging your numbers into this formula, you can calculate exactly how much your investment will grow over time thanks to the power of compounding.

Best Investment Strategies to Maximize Compound Interest

Compound interest is a powerful force that can significantly grow your wealth over time. By earning interest on both your principal and accumulated interest, your investments can snowball, leading to exponential returns. To harness the full potential of compound interest, consider these investment strategies:

1. Start Early and Invest Regularly: Time is your greatest ally when it comes to compound interest. The earlier you start investing, the longer your money has to grow. Even small, regular investments can accumulate significantly over time.

2. High-Yield Savings Accounts and Money Market Accounts: For lower-risk investments, consider high-yield savings accounts or money market accounts. While interest rates may be lower than other investment options, they offer stability and liquidity.

3. Certificates of Deposit (CDs): CDs typically offer higher interest rates than savings accounts in exchange for locking in your money for a fixed period. By choosing CDs with varying maturity dates, you can create a “CD ladder” to maximize returns and maintain liquidity.

4. Bonds: Bonds are debt securities that represent loans made to governments or corporations. They offer regular interest payments (coupon payments) and the return of principal at maturity.

5. Dividend-Paying Stocks: Investing in dividend-paying stocks can provide both capital appreciation and a steady stream of income. Look for companies with a solid track record of dividend payments and the potential for future growth.

6. Real Estate: Real estate investments can generate rental income and appreciate in value over time. Consider factors such as location, property type, and market conditions.

7. Reinvest Your Earnings: To truly maximize compound interest, reinvest your earnings back into your investments. This allows your money to grow at an accelerated rate.

8. Consult with a Financial Advisor: A financial advisor can help you create a personalized investment strategy tailored to your specific financial goals, risk tolerance, and time horizon.

Remember that all investments carry some level of risk, and past performance is not indicative of future results. Diversifying your portfolio across different asset classes can help mitigate risk and optimize returns. By embracing the power of compound interest and implementing these strategies, you can set yourself on the path to long-term financial success.

Common Mistakes to Avoid with Compound Interest

While compound interest can be a powerful tool for growing your wealth, it’s important to avoid common pitfalls that can hinder your progress. Here are some mistakes to watch out for:

1. Starting Late: Time is your greatest ally when it comes to compound interest. The earlier you start investing, the more time your money has to grow exponentially. Even small contributions made consistently over time can lead to significant returns in the long run. Don’t delay, start investing today!

2. Withdrawing Early: Just as starting early is crucial, withdrawing your investments early can significantly impact your returns. Every time you withdraw funds, you’re reducing the principal amount that is compounding. Resist the temptation to dip into your investments unless absolutely necessary.

3. Ignoring Fees: High fees can eat into your investment returns, reducing the power of compounding. Be mindful of expense ratios charged by mutual funds and ETFs, as well as trading commissions. Opt for low-cost investment options to maximize your returns over time.

4. Not Reinvesting Earnings: To fully harness the power of compounding, reinvest your earnings. When you reinvest dividends, interest, or capital gains, you’re essentially compounding on your previous returns, accelerating your wealth-building journey.

5. Lack of Patience: Compounding takes time to work its magic. Don’t get discouraged by slow growth in the early stages. Stay patient, remain invested, and let the power of compounding work its magic over the long term.